15 Jan 24

Insight

Global Equities

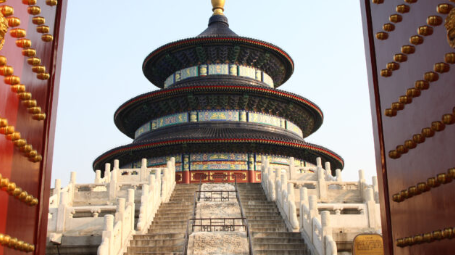

Why Bother Investing in China?

The investment philosophy of Ox Capital is to buy champion businesses of the future when valuations are depressed. Typically, reason for the negativity is obvious. Our job, as long-term investors, is to look past short-term disruptions, and determine if the businesses possess strong economic moat which enable them to become champion companies in the future.

10 Jan 24

Insight

Alternatives

The Mining Industry: How to fuel the green energy supply chain sustainably

The green transition depends on essential mined materials, however, mining is a linear, extractive industry that consumes a great deal of energy and pollutes local ecosystems. ‘Greening’ production is essential to reducing heavy industry’s environmental impact especially as we accelerate the transition towards a more climate-friendly economy.

Co-locating appropriate renewable energy and water treatment assets on new and existing sites can achieve waste reduction, circular production and sustainable exploration.

12 Dec 23

Insight

Fixed Income

ESG in 10 -Episode 14: Why Europe is the region leading Sovereign Green Bond issuance, with Ardea

Charlotte O'Meara is joined by Gillian Jago, Senior Trader at Ardea Investment Management, to explore the dominance of Europe in sovereign green bond issuance amid a global slowdown.

11 Dec 23

Insight

Fixed Income

What this bond investor is watching most closely into 2024

Ardea Investment Management's Gopi Karunakaran explains how he spots opportunity and discusses the big conflict in central bank policy now.

28 Nov 23

Insight

Fixed Income

ESG in 10 -Episode 13: Navigating the Landscape of ESG in Asset Backed Securities, with Challenger Investment Management (CIM)

Delve into the challenges and advancements of integrating ESG considerations in Asset Backed Securities (ABS).

21 Nov 23

Insight

Fixed Income

Why Europe is the region leading sovereign green bond issuance and what we expect for the last three months of the year

Europe continues to dominate in the green bond space in 2023, with most green bonds issued either by a European name or denominated in EUR. Following Poland as the first sovereign to issue a green bond in 2016, supply and demand for Supranational, Sub-Sovereign and Agency (SSA) green bonds in Europe has continued to grow.

16 Nov 23

Insight

Alternatives

Defensive Equities: When Defence is the Best Offence

In uncertain times, investors looking for shelter can consider an allocation to defensive equities to shore up their portfolio. Listed infrastructure, listed property and low volatility strategies are all different ways to invest in defensive equities, all of which also provide investors with an income yield.

01 Nov 23

Insight

Fixed Income

Challenger Investment Management launches Global ABS Fund

Challenger Investment Management (CIM), part of the ASX-listed investment management firm Challenger Limited, is pleased to announce the launch of the Challenger IM Global Asset Backed Securities Fund (‘The Fund’).

16 Oct 23

Insight

Fixed Income

Article 8, Promoting Environment & Social Characteristics

Since the European Union's Sustainable Finance Disclosure Regulation (“SFDR”) came into force in March 2021, asset managers have been required to provide more information on the sustainability risks and impact of their investment products sold in the European Union.