Beyond Uncertainty: Building resilient portfolios at the Defensive Markets Forum

Note: this material is intended for an adviser audience only.

In a world filled with uncertainly, investors and advisers are turning to fixed income amongst concerns of stretched equity markets and inflated valuations. However, with bonds and equities increasingly correlated, is it time to rethink the traditional defensive role of fixed income in portfolio construction.

Challenger and Fidante welcomed 228 advisers and investors nationwide to our Defensive Markets Forum to answer this question. Looking beyond uncertainty, a line-up of local and global speakers shared new ways to reimagine and redesign resilient portfolios.

The financial world is changing and market conditions in the next three-to-five years will be markedly different from decades past. Renowned investment specialist, Giselle Roux, turned our attention to the host of inflationary pressures, differentiated global monetary policy, and unusual fiscal spending that needs to be considered in portfolio construction. With diverse strategies becoming increasingly important, she questioned whether it was time to re-examine the traditional 60/40 portfolio through a new lens and the need to incorporate a differentiated approach beyond the traditional equity / bond structure to deliver better client outcomes.

A third lever

Fixed income traditionally relies on two ‘levers’ to manage risk: credit and duration. However, fixed income has undergone a regime shift and bond markets are increasingly volatile with equity-like fluctuations. 2022 was an extreme example of this where the market saw significant, correlated dips in both bonds and equities. It was not an anomaly – there is likely more where that came from.

Gopi Karunakaran, Co-Chief Investment Officer at Ardea Investment Management (Ardea), introduced us to a third lever to improve diversification, mitigate risk, and drive returns: Pure Relative Value (PRV). With PRV, returns are extracted by exploiting market inefficiencies through trading strategies. It has a return profile independent of yields, interest rates, inflation, and macroeconomic pressures – all elements that impact the two traditional defensive levers dramatically. A track record of delivering positive returns during most market downturns makes PRV an ideal risk diversifier.

Ardea provides access to this third lever of fixed income through the Ardea Real Outcome Fund (ARO). Proven across market cycles, it plays a long-term strategic portfolio role as a defensive risk diversifier, targeting a return of AUD cash rate + 2% p.a. and volatility of 2% p.a.

Going private

The opportunity and growth in private credit is at a tipping point in Australia. Private credit plays an important role in generating income, diversification, and downside protection in portfolios. As one of ANZ’s largest and most experienced credit investors, Challenger Investment Management (CIM) manages $16.7bn in AUM, with $3.6bn allocated to private credit. This meaningful scale leads to better deal access, impactful engagement, and superior longer-term outcomes for investors.

Standing out as a differentiator for CIM is governance. CIM passes on all fees received from Borrowers on the portfolio to investors, and only charges an AUM-based management fee. CIM also marks all private investments to market on a monthly basis (based on liquid market spreads provided by independent third parties), especially since CIM funds are open ended. CIM also has an independent credit risk team reporting directly to the Challenger Chief Risk Officer to approve all investments; this mitigates conflict by ensuring that the investment team does not have unilateral authority to approve investments.

Holding more than 200 private credit investments in the portfolio, CIM understands no two deals are equal. Sid Kumar, Head of Acquisition Finance at CIM, shared two recent case study examples of this – one where CIM was able to achieve outsized pricing for risk taken through superior speed of execution and another where CIM was able to defend its incumbent position in a credit by being flexible on terms and provide a solution across the capital structure.

Investors can expect access to a high calibre of deals through CIM’s investment strategies, the Challenger IM Credit Income Fund (CIF) and the Challenger IM Multi-Sector Private Lending Fund (MSPL). CIF is a floating rate, multi-sector credit strategy aiming for a return of Bank Bill Index + 3% p.a. (after fees) by targeting an investment grade credit profile and has consistently outperformed since inception*. MSPL is a long-only, multi-sector strategy concentrating on private credit in Australia and New Zealand. It targets a return of Bank Bill Index + 5% p.a. (after fees) and has also outperformed since its inception*.

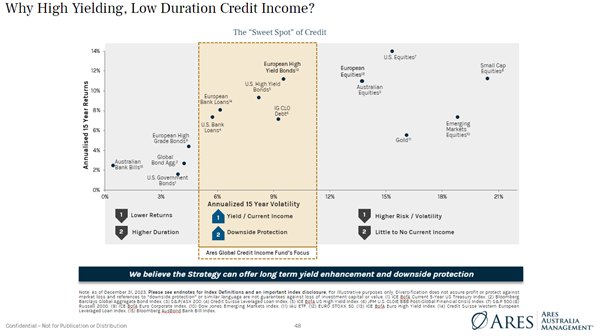

Finding the ‘sweet spot’

Turning our attention global, we were joined by Samantha Milner, Partner and Portfolio Manager in the Global Liquid Credit group at Ares Management (Ares), one of the world’s largest credit managers with over half a trillion in AUM (AUD). Visiting from the US, Samantha shared how Ares targets attractive returns without excess risk by finding the sweet spot in credit.

Current income, not duration, drives returns and by focusing on floating rate, low duration assets, Ares seeks to deliver high income with minimum price volatility. We believe it is a time-tested strategy, with Ares Global Credit Income Fund delivering a net return of 9.2%, volatility of 2.6%, and zero defaults in 2023.* Attractive spreads and solid fundamentals help to provide downside protection, while high yields point to attractive potential forward returns.

Looking ahead, Samantha shared spreads are wide in parts of the market compared to historic levels, offering a compelling opportunity. The Ares Global Credit Income Fund (AGCIF) is well positioned to capitalise on this opportunity by investing in loans with strong income and high yield bonds trading at a discount with upside convexity. As we navigate a more normalised interest rate environment, AGCIF features an attractive go-forward return opportunity with a tactical asset allocation approach and disciplined fundamental credit underwriting.

Defending the golden years

Defensive portfolios play an important role in protecting and preserving capital in our golden years. With 2.5 million Australians set to retire in the next 10 years, the retirement trilemma (outlined in the Retirement Income Covenant) is in focus: maximising retirement income, providing flexible access to capital, and delivering stable, sustainable income.

The Mercer presentation featured the latest actuarial modelling demonstrating that substituting defensive assets for annuities in this environment may improve investment outcomes.

Bringing the modelling to life with a case study, a couple with a $1 million super balance and $85,000 target income, can see an 8% increase in retirement income through a 30% allocation to annuities. Mercer noted the traditional benefits of annuities remain while historical issues, such as death benefits, have been diminished.

Australians share a common goal in the accumulation phase, building wealth, but retirement is unique for each client and one strategy does not suit all. In partnership with Challenger, Mercer will be releasing its Principles of Retirement Annuitisation Report in the coming weeks outlining further modelling and case studies of the role of annuities in a retirement portfolio.

While uncertain times lie ahead, there is no doubt fixed income will continue to play an important defensive role. However, it may pay to think outside the box, redesigning traditional portfolio construction to maximise benefits. To find out more on how Challenger or Fidante and its affiliates can deliver superior investment solutions, get in touch with your local Challenger or Fidante BDM.