Expanding the Investable Universe with Alternatives

For the better part of four decades, the balanced 60/40 portfolio model (60% equities, 40% bonds) delivered diversification for investors. However, 2022 marked a turning point. In response to rising inflation, the US Federal Reserve raised its target rate from zero to 5.5%, resulting in significant drawdowns across both equity and debt markets. This led to a scenario where both asset classes delivered double-digit negative returns. In the US, equities were down 18% and fixed income down 13% . Consequently, investors with 60/40 portfolios experienced painful losses, highlighting the need for diversification beyond traditional asset classes.

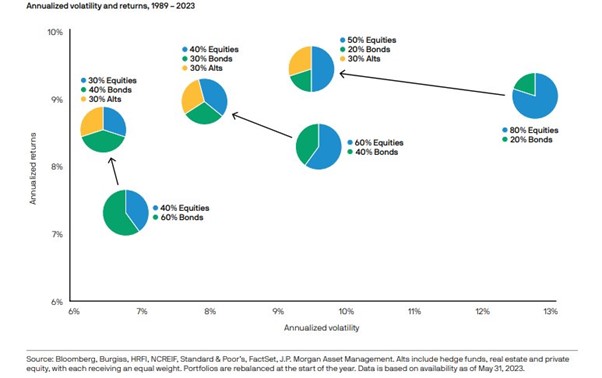

Incorporating alternative assets into a diversified portfolio can significantly enhance risk-adjusted returns. History shows that portfolios including alternatives such as private credit, hedge funds, real estate, and private equity tend to exhibit lower annualised volatility and higher returns.

Alternative assets cover a wide range of asset classes, each contributing unique characteristics. Institutional investors often explore this spectrum to select the most suitable assets and weightings based on their objectives. For example, hedge funds may provide uncorrelated returns, while real estate offers both income and capital appreciation potential.

Institutional investors allocate, on average, over 30% of their assets to private markets, compared to just 6% for non-institutional investors (McKinsey). While the illiquidity of alternative assets is a consideration, in most cases, not all investments need to be liquid.

When investing in public equity markets, you become part-owner of a company, and when buying a bond, you are lending money to a company. The same principles apply to private equity and private credit, offering similar ownership and lending opportunities in a less liquid but potentially more rewarding environment.

Why Invest in Private Markets?

Illiquidity Premium

Private markets offer an illiquidity premium, providing the potential for enhanced returns for investors willing to lock up their capital for a certain period. Similar to public markets, investments within private markets move in cycles and are influenced by the macroeconomic environment. For instance, a low interest rate environment benefitted private equity (PE), while higher interest rates create attractive opportunities for private credit (PC). Regardless of the prevailing market conditions, the illiquidity premium inherent in private markets serves as a significant return enhancer.

Diversification and Lower Correlation

Given the higher correlation between stocks and bonds observed in recent times, investors are seeking new sources of diversification and returns. Markets face challenges such as higher financing and input costs, which often constrain earnings growth and multiple expansion. The S&P 500 might be trading at all-time highs, but this is largely driven by the performance of a few top companies, often referred to as the "Magnificent 7 ." The rest of the market has exhibited tepid returns in 2024, emphasising the need for alternative investments to act as shock absorbers in a diversified portfolio.

Increasing Stay-Private Trend Among Companies

A significant trend in recent years is the increasing number of companies choosing to stay private for longer periods. At the beginning of 2000, there were 7,810 publicly listed companies. By the end of 2020, this number had dwindled to 4,814. Currently, 87% of US companies with revenues exceeding $100 million remain private , a pattern echoed in Europe. By not investing in private markets, investors miss out on a substantial portion of the market.

Larger Investable Universe in Equities

The sheer size of private markets presents a vast investible universe. Unlike public markets, where companies regularly release results, private markets are less researched, creating information asymmetry that presents opportunities for astute investors. Many "unicorns" (companies valued at $1 billion or more) stay private until they have a valuation of over $10bn, meaning significant portions of their returns are achieved through private financing. For instance, Uber and Airbnb disrupted their respective industries well before they went public.

Larger Investable Universe in Credit

Globally, banks have been reducing their commercial lending books due to regulatory changes that make some types of lending, particularly in commercial real estate, too capital-intensive. This has opened opportunities for private lenders to offer bespoke, tailored financing solutions with speed and certainty of execution. Consequently, banks' share of private lending in the US economy has fallen from 60% in 1970 to 35% last year , highlighting the growing role of private credit.

Conclusion

The current economic landscape necessitates a re-evaluation of traditional investment strategies. With rising interest rates and higher correlations between traditional asset classes, the need for diversification through alternative investments has never been more critical. Private markets offer potential for enhanced returns, greater diversification, and a larger investible universe, making them an indispensable component of modern portfolios.

To learn more about how you can expand your investable universe and optimise your portfolio with alternative investments contact your local Fidante BDM today.