The FED doesn't blink

Kapstream's Portfolio Manager, Dan Siluk, explains why the Federal Reserve (Fed) opted to raise rates and highlights the threat posed by persistently high inflation despite recent upheaval in the banking sector.

Key takeaways:

- While acknowledging the recent developments in the banking sector, Fed Chairman Jerome Powell emphasized that the central bank’s primary focus continues to be guiding inflation toward its 2.0% target.

- Although relatively hawkish, the Fed’s move was likely tempered by tightening credit conditions weighing on consumers’ and businesses’ ability to borrow, which could act as an economic headwind.

- A bullish pivot likely doesn’t await investors, but by delivering a 25 basis point (bps) rate hike, the Fed may have decreased the chance of a policy error that could send bond yields markedly higher.

After nearly two weeks of speculation, with a few pointed sentences Federal Reserve (Fed) Chairman Jerome Powell reaffirmed that the Federal Open Market Committee’s (FOMC) highest priority remains price stability, while also acknowledging that recent banking sector upheaval and its impact on credit availability are developments they cannot dismiss. By shifting the focus back to inflation and a tight labour market despite indications of a slowing economy, Chairman Powell provided the context for the FOMC’s 25 bps rate hike to a range of 4.75% to 5.00%.

Even with the focus squarely on inflation, we believe the impact of the banking turmoil was already evident in Chairman Powell’s statement. In his Congressional testimony only a few weeks ago, he hinted that rates would likely have to rise higher than the market anticipated. Taking him at his word, futures prices responded by implying the terminal rate would climb as high as 5.75% in mid-2023. Fast forward to Wednesday and his message morphed to a less certain “some additional policy firming may be appropriate.”

All eyes on the mandate

Citing “robust” job gains keeping stickier drivers of inflation – e.g., wages – elevated, Chairman Powell emphasized that there is much work to be done in achieving the Fed’s objective of 2.0% inflation. This meeting’s update to the Summary of Economic Projections reflected the Fed’s modestly hawkish thinking. Estimates for 2023 headline and core inflation were revised upward to 3.3% and 3.6%, respectively. The challenge facing the Fed is acutely illustrated in the incongruity of paltry 2023 gross domestic product growth of 0.4% and the year’s unemployment rate being revised down to 4.5%.

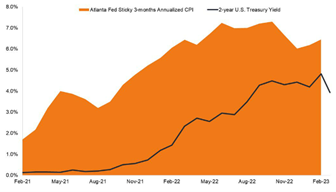

While banking sector turbulence has sent 2-year Treasury yields lower, sticky inflation could reverse that trend

Source: Bloomberg, as of 22 March 2023.

Given the recent developments in the banking sector, we had suspected that the Fed could have considered a 2023 pivot as lenders’ health can materially impact financial conditions. Chairman Powell, however, dismissed that scenario, noting that the FOMC does not see a rate cut occurring this year. In fact, the Fed’s much ballyhooed DOTS survey revealed that respondents see the fed funds rate finishing 2024 at 4.3% – slightly higher than the 4.1% suggested in its December survey. We interpret this as the Fed being willing to leave rates at their cycle high for longer than what the market is currently pricing in. Such a pause would give the central bank time to assess the impact of previous rate hikes and other tightening initiatives.

We believe the Fed was correct in shifting the conversation back toward its battle with inflation. Even before most people had ever heard of Silicon Valley Bank (SVB), the Fed was faced with striking a delicate balance between reducing inflation and inflicting as little harm as possible on the economy. That battle has not gone away.

Breaking something

Arguably, the genesis of the current banking turmoil was last year’s rise in interest rates, which led to the mismatch between SVB’s assets and liabilities and resulted in the run on the bank. We often state that the purpose of monetary tightening is to break something. Typically, what gets broken first are the weaker business models and pockets of the economy that are dependent upon low rates. While regional banks with narrow customer bases may be the first segment to give way, they may not be the last, and investors must be wary of what else higher rates could expose.

In his statement, Chairman Powell emphasized that the U.S. banking sector was “sound and resilient.” This is due, in part, to the action taken by the Fed in concert with the U.S. Treasury to shore up banks’ access to funding. Thanks to the alphabet soup of policy prescriptions created during the Global Financial Crisis, the Fed has a full cupboard of facilities well-suited to addressing financial stability. This leaves the fed funds rate available for the task at which it’s effective: addressing inflation.

Bringing this full circle, the stress to regional banks that initially caused a historic rise in rates may, in the end, assist the Fed in tightening financial conditions. Mr. Powell made a point to highlight that households and businesses are likely to face tighter credit conditions. This is in addition to higher rates already negatively impacting the housing market and business investment.

Narrowing rates’ range of outcomes?

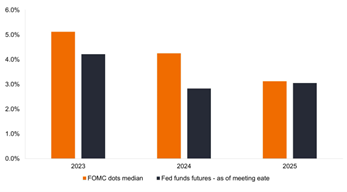

We think recent developments – and the Fed’s decision – leaves much for investors to digest. In one respect, the added headwind of tightening credit conditions means that the near-term ceiling for interest rates may be lower than it was in early March. This could lead to lower volatility in shorter-dated bonds. Still, we see a disconnect between the yield on the 2-year U.S. Treasury of roughly 4.0% and the end-of-2023 DOTS projection of 5.1% for the fed funds rate. This disparity may reflect the Fed’s concern that it’s too soon to declare victory in its battle against inflation.

In contrast to the Fed’s expectations for its benchmark rate, the futures market believes a dovish pivot is in the cards by the end of 2023

Source: Bloomberg, as of 22 March 2023.

Recent market and economic developments have no doubt tested the Fed. We appreciate that its focus remains on price stability, as imbedded inflation expectations can lead to long-lasting price distortions across the economy. By recognizing that it has the facilities at its disposal to address financial stability, the Fed can keep another 25 bps rate hike on the table should consumer prices remain uncomfortably hot and the labour market tight.

In choosing a circumspect hike rather than the pause many had called for, the Powell Fed, in our view, has passed the initial test of not blinking at the first sign of something breaking, which – as history has shown – only results in more difficult battles down the road in containing inflation and longer-term rates.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

The Federal Open Market Committee (FOMC) is the body of the Federal Reserve System that sets national monetary policy.

The FOMC dot plot is a chart that summarizes the FOMC’s outlook for the federal funds rate.

This material has been prepared by Kapstream Capital Pty Limited (ABN 19 122 076 117 AFSL 308870) (Kapstream), the investment manager of the Kapstream Absolute Return Income Fund & Kapstream Absolute Return Income Plus Fund (‘Funds’). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Funds Target Market Determination and Product Disclosure Statements (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Funds. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Kapstream and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Kapstream and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.