How Fixed Income Investment Managers Generate Returns

Fundamentally, all Fixed Income investment managers have the same select number of ways to generate excess returns when designing their portfolios. These choices can have a big impact on the end investor, not just in terms of how much return they generate but also how much downside the funds may experience through the cycle.

Duration

Generally speaking, a good investment manager will demand a higher premium for taking on a longer-term investment. As a simple banking example, retail investors can often receive a higher rate on a term deposit than on an at-call account.

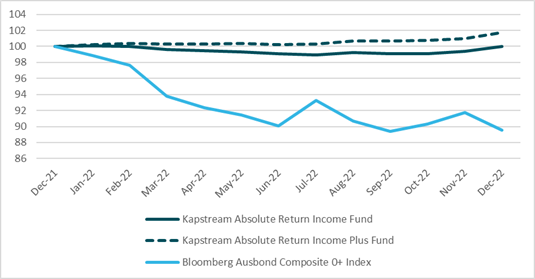

Fixed income managers and investors similarly have a choice about how much additional return they want to generate by increasing the average time to maturity for the bonds held in their portfolio. This is referred to the ‘duration’ of the portfolio, and broadly is the time (in years) it takes to be repaid through coupon income for the initial outlay of the bond. However the additional return on offer comes with a catch. The longer the duration, the greater the sensitivity of the value of the bond or portfolio to movements in interest rates. For example, a common fixed income benchmark, the Australian Bloomberg Ausbond Composite Bond index, has a duration of more than five years. This duration is considerably higher than what Kapstream generally operates to, which enabled our fund to significantly outperform the broader market over 2022 when yields rose sharply.

Credit Quality

Your investment manager will also be asking for a higher return for the additional risk relating to the credit quality of the issuer, otherwise meaning the confidence in that issuer to be able to make their interest payments and repay their capital upon maturity of the bond. Investing in a BBB rated corporate bond should earn you a significantly higher ‘credit spread’ return – being the amount above the ‘risk free’ rate that a company has to pay in the bond market to borrow money – than say a AAA rated government bond, all else being equal. The same applies at the portfolio level.

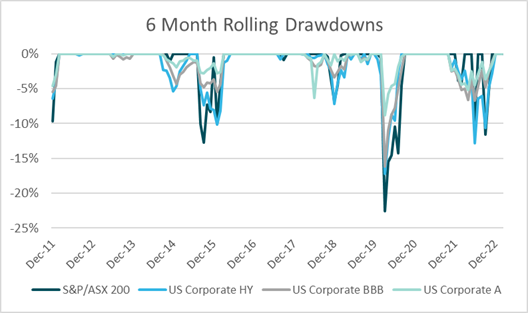

Similar to duration, the more return you seek to generate this way increases the sensitivity of the portfolio to both market-wide and idiosyncratic movements in credit spreads. The charts below show the downside experience for investors if they were exposed to equities and different forms of credit exposures. A manager that looks to add returns going too far down the credit quality spectrum can result in a downside experience outside of the risk tolerance of the investor. Kapstream’s philosophical preference is to have a lower sensitivity to credit quality relative to its peers, thereby delivering the additional income that credit offers with much less volatility in the overall value of the portfolio. The current challenges in the banking sector are a good example of the credit risks an investor wants to be compensated for.

Illiquidity Premium

An illiquidity premium is the additional compensation an investor receives for not being able to readily access their investment. Funds investing in private debt are a good example, as these are much less frequently traded than their public equivalents. One way an investment manager can increase returns is to increase the amount that is held in less liquid assets to capture this additional spread. However, if this is not consistent with the liquidity goals of the investor there can be a significant issue when investors need more ready access to their money.

Leverage

Leverage allows you to borrow against your assets and invest those proceeds to increase your exposure to any of the above levers. This increases the risk and volatility of the investments in a portfolio and is also associated with lower recovery rates if things turn ugly, for example if defaults occur. This is not a path Kapstream utilises to generate returns.

How Kapstream’s Choices Impact Investors

Kapstream’s philosophical approach to the extent of use and combination of the above return ‘levers’ reflects the preference that its investors are provided with a ‘sleep at night’ solution carrying low risk. The duration of the portfolio, and therefore its sensitivity to interest rate changes, is low, at around an average of one year (and currently considerably less while interest rate uncertainty persists). It also predominantly invests in liquid, high-grade credit, also of a relatively short time to maturity, which means it can deliver the income from having higher yielding credit without the larger negative impact from increases in yields or credit spreads widening. Lastly, Kapstream also concentrates on the most efficient combination of rates and credit that best delivers on return objectives without exceeding the volatility and capital preservation requirements that our risk-averse investors typically desire. This gives it a superior risk-adjusted return profile to funds that have an unduly large exposure to duration, as well as those managers that are only focused on generating returns via credit quality, illiquidity premium or leverage alone.

This material has been prepared by Kapstream Capital Pty Limited (ABN 19 122 076 117 AFSL 308870) (Kapstream), the investment manager of the Kapstream Absolute Return Income Fund & Kapstream Absolute Return Income Plus Fund (‘Funds’). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Funds Target Market Determination and Product Disclosure Statements (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Funds. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Kapstream and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Kapstream and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.