Key Themes for 2024

Towards the start of each calendar year banks and investment managers like to publish their predictions for the year-ahead. In fixed income, these notes are usually heavily focused on macro forecasts around the level and direction of interest rates.

The difficulty with macro forecasting is it has poor historical track record, generally being no better than a random coin toss. Even worse, macro forecasts tend to be most wrong when they matter most, which is during macro regime shifts.

At Ardea Investment Management (Ardea IM), macro forecasting is not part of our investment process as we adopt a pure relative value investment approach that aims to be independent of the level of bond yields, the broad direction of interest rates and the macroeconomic factors that dominate the performance of conventional investments.

Therefore, instead of the traditional year-ahead forecasts, in this note we highlight a number of key themes that will impact global interest rate markets in 2024 and consider the risks around some of these consensus views:

- The peak of inflation and central bank policy

- Increasing net bond supply

- Bond market volatility

- Duration Risk – bonds are back?

- Relative Value investing – opportunities and diversification.

1. The peak of inflation and central bank policy

2024 is widely forecast to mark the end of one of the fastest and most aggressive central bank tightening cycles. Markets are now turning their attention to the timing and size of potential rate cuts however a return to the ultra-low rates environment appears remote. Investment banks and asset managers have varying calls for yields which reflects division over whether the U.S. economy in particular will enter the long-heralded recession dragging the world with it. This lack of consensus is in contrast to a year ago, when most incorrectly predicted a U.S. recession resulting in rapid rate cuts, in fact in the third quarter of 2023 the US economy expanded by over 5%.

Central banks have been successful in bringing inflation down from its peak, tackling the last leg of this battle can expect to be the hardest in the inflation fight. A multitude of challenges, from a transforming geopolitical landscape to the costs of the energy transition and infrastructure building amongst others lie ahead. Although inflation has seen a swift decline in many cases, reducing it from say 4% to 2% will be a tougher challenge than the journey from 9% to 4%.

How central banks navigate these stubborn last percentage points of inflation will significantly impact whether we experience an economic soft landing or a harder one, the trajectory of bond yields will be influenced by this outcome. Globally, economic activity appears to be tapering, notably in Europe, evident in declining indicators such as capacity utilisation and the purchasing manager’s index. It is reasonable to anticipate that bond volatility will remain high in this environment.

While the markets see central banks as having concluded their upward rate adjustments, central banks themselves are not ruling out the possibility of further rate hikes if inflation persists and economies remain strong and view speculation around near-term rate cuts as premature. Despite this market attention has shifted to the potential timing of rate cuts through 2024, with more aggressive cuts, both timing and size, anticipated in the US and EUR markets.

Macro-focused investment strategies will face uncertainty regarding these future rate moves, especially amid the possibility of varying speeds and impacts of slowing growth across economies. For instance, while the US could evade recession, there’s potential for the UK and parts of Europe to face one. Markets which have a higher proportion of floating-rate mortgages expedite the transmission of higher interest rates to housing markets and households.

Looking at Australia in 2024, ongoing policy uncertainty prevails. The consensus on RBA monetary policy suggests it will likely remain unchanged for some time, with a potential easing cycle only beginning late in 2024. There is, however, the possibility of a nearer-term rate hike if inflation surprises positively in the upcoming CPI releases and if labour market resilience endures. The RBA has signalled a data-dependent approach for any rate moves, particularly with inflation.

Current interest rate policies across developed markets are viewed as restrictive. However, if the last leg of the inflation battle persists, bond yields have the potential to again move higher and be volatile as the anticipated easing’s of monetary policies the market has priced are potentially delayed and less aggressive through 2024.

2. Increasing net bond supply

Following the COVID period, most governments are dealing with expanding deficits, this is notable in the case of the US government, whose budget deficit has ballooned to $1.7 trillion due to the rapid surge in deficit spending.

Consequently, there is a significant increase in net government bond supply. Governments are issuing significantly more bonds to cover these larger deficits precisely at a time when the main buyers (central banks) are cutting back on their purchases, transitioning from quantitative easing (QE) to quantitative tightening (QT), and shrinking their balance sheets. The cost of financing this level of debt has become significantly more expensive.

The big question is: who will step in to buy all these bonds? With central banks stepping back, the other historically prominent buyers have been Japanese investors and China. Japan and China are the largest foreign holders of US Treasury bonds. However, Japanese investors no longer enjoy the same benefits from buying overseas bonds and swapping them back into YEN for higher returns, as domestic yields are now more appealing. Similarly, China’s demand for offshore bonds has decreased due to financial system stresses, particularly in the property sector, resulting from slower growth and increased risk aversion. The People’s Bank of China’s efforts to defend the yuan in the face of this economic turbulence will likely involve the selling of US Treasuries.

Private investors will have to absorb a substantial portion of this increased supply. These investors are more sensitive to yields and prices compared to central banks, which were price-insensitive buyers. Markets will be on the lookout for signs of investor fatigue, tracking whether new bond issues are coming with longer clearing tails and low bid/cover ratios. The additional bond supply will vary across markets and could lead to underperformance in bonds and steeper curves, particularly in regions facing the heaviest supply like the US, Europe, and the UK. The following chart illustrates the forecasted net supply of EGBs and EU bonds throughout 2024.

With the increase in supply, growing uncertainty and increased volatility, investors will seek a higher term premium. The term premium signifies the additional compensation investors require for holding a longer-term bond rather than opting for a series of short-term bonds. This shift results in steeper yield curves, which means a growing difference between short-term bond yields and long-term yields.

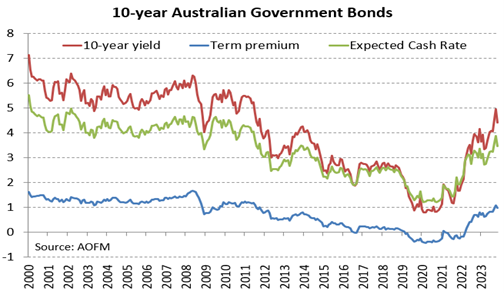

The following chart shows the increase in the Australian 10-year yield has been driven by rising cash rate expectations as well as a modest increase in the term premium, with both factors contributing.

Measuring the term premium involves decomposing government bond yields into two key components, 1) a component based on the expected future path of short-term rates; and 2) a term premium component.

3. Bond market volatility

Government bond and interest rate markets are in a new regime of structurally higher volatility.

Government bonds remain highly volatile due to the macro uncertainty around inflation and slowing economies. A key theme is that central banks have transitioned from being suppressors of market volatility, which they had been since the GFC, to now acting as volatility amplifiers.

Central banks had previously been swift to intervene whenever market stress emerged, either in the shape of interest rate cuts or quantitative easing. However, with policy uncertainty and central banks aggressively running down their pandemic-era bond portfolios we consider the worlds’ reserve banks to be amplifiers of volatility.

As a result, when combined with the increase in supply, government bond and interest rate markets are now in a regime of structurally higher volatility, which means that for any level of bond yields investors should now expect materially higher price volatility and therefore more variable returns.

The MOVE index, gauging US Treasury option implied volatility, surged to its highest level since the GFC in March 2023 following the challenges faced by U.S. regional banks – Silicon Valley Bank (SVB) and Signature Bank collapses – and remains elevated. The following chart highlights that volatility levels remain elevated and above the 20-year average, volatility also remains above the 30-year average. Comparable measures of volatility in European and UK rates also remain high. As the market anticipates the size and speed of interest rate easing’s volatility is likely to remain high.

Whilst rates volatility delivers variable performance outcomes for bond duration and macro focused strategies it is positive for pure relative value portfolios which highlights the benefit of diversification in the defensive risk allocation in portfolio construction.

4. Duration risk

Duration is one of three key fixed income levers, alongside credit and pure relative value.

Duration has gone through a difficult period over the past few years due to low, then no and then swiftly increasing bond yields.

2023 was billed as ‘the Year of the Bond’, however as with the previous two years bond yields continued to move higher over most of the year with Australian and US 10y bonds reaching a high of 5% at the end of October before declining quickly back towards 4% into year end. This is the same yield level as the start of the year. When bond yields rise, bond values or returns fall. Interestingly, the anticipated recession for 2023 did not come to pass as was widely expected.

For 2024 ‘Bonds are Back’ maybe the catch phrase as many bond market participants are again calling for bond markets to perform in the coming year as the risk/reward improves with the consensus view that inflation declines, and growth slows. In this environment fixed interest duration becomes a consideration for investors. The main risk to this outlook is that economies remain robust, avoid a recession, inflation stays elevated and volatility persists.

As we noted in last year’s themes paper, long term government bonds in 2020 and 2021 were better described as return free risk during the period of ultra-low interest rates. Those ultra-low bond yields fundamentally changed the risk versus return proposition of bonds and challenge the tradition view about the defensive role bonds play in multi-asset portfolios.

A factor improving the outlook for bond duration investing is the yield cushion. The cushion refers to the current yield level acting as a buffer against potential decreases in value, that is, a loss from increasing bond yields can be offset by the yield accrual. The chart above highlights the index yield has increased significantly from the zero rates of 2020 and is now back at 2012 levels. Although the rapid decline in yields since the end of October 2023 has reduced some of this buffer.

Bonds again offer potentially attractive returns and can help protect portfolios in a downturn. For the domestic index above, which has a modified duration of around 5 years – modified duration measures the sensitivity of a bond to change in interest rates, a 1% parallel increase in the index yield could produce a total return of around -1% return over the 12-month period while a 1% decline in the index yield could deliver a total return of around +8.5%. Volatility around these outcomes is likely to be high. Noting a neutral return when cash is delivering 4.5% to 5% might not satisfy all investors.

The role for bond portfolio beta exposure (duration) in multi-asset portfolios can again provide diversification benefits, especially when combined with credit and pure relative value investing, see our three levers paper here. A point to note is the bond to equity correlation has been positive over H2 2023 which implies that the prices of bonds and equities move in the same direction. It is also important to note that higher bond yields do not always mean higher bond returns over a given period as yield is compensation for duration risk. While historically investors could simply rely on bond duration to diversify equity risk uncertainty about inflation and the path of interest rates means the duration component has become more volatile and has a more volatile relationship with equities. As a result, diversification within the defensive sector allocation becomes important. The changing landscape highlights the importance of fine-tuning fixed income allocations in multi-asset portfolios. Given the current market consensus pricing for bond yields they could move higher quickly and potentially dramatically should the timing of potential rate cuts be delayed.

Whilst the return from cash remains attractive adding diversified bond exposures can deliver additional returns. Bonds can protect against key tail risk and perform strongly if recession risks or if geopolitical risks increase.

It is worth noting that the other common fixed interest lever is credit and there are some risks for credit in 2024 – in an environment where credit risk is elevated. Investment banks such as Citi Bank and Deutsch bank, are forecasting default rates to increase throughout 2024, peaking around year end. This will likely impact credit spreads particularly in lower credit rated issuers. Over recent months S&P Global Ratings’ 2023 global corporate default tally in some sectors has reached some of the highest monthly tallies since 2009. Rating agencies Moody’s and Fitch both forecast the U.S. high yield default rate to reach 5% in the next twelve months, reflecting the cost of higher interest payments at a time when slowing economic growth threatens company earnings.

5. Relative Value investing

An additional or 3rd lever in the fixed income toolkit is Pure Relative Value (RV) investing, which is Ardea IM’s specialty. It stands apart from conventional levers like duration and credit offering diversification in the defensive asset allocation.

We see 2024 as a positive environment for RV investing as higher bond price volatility and greater dispersion of pricing between similar bonds creates a fertile opportunity set for market-neutral RV trades.

RV investing targets groups of securities which have similar risk characteristics, but which trade at different prices and usually involve a combination of long and short positions. The resulting RV premium demonstrates lower volatile and is uncorrelated with other asset classes and risk factors in a portfolio.

As the macro environment changes there tends to be a diverse reaction among FI market participants – forced selling, profit taking, hedging or position taking. Our portfolios profit from this via RV trades that isolate exposure only to the relative price movements between mispriced securities, detached from broader market fluctuations. Once the demand/supply imbalance resolves, relative pricing consistency returns, and we exit the trades at a profit.

Unlike the other fixed interest levers, opportunities in interest rate RV do not rely on the broader level and direction of rates, risk asset performance, or macro variables like growth and inflation. While there is not a definitive market scenario favouring pure RV portfolios, there are some general connections with broader market environments:

- Rates volatility is generally positive and required for RV investing, however extreme volatility poses challenges e.g., 2022 witnessed extreme volatility leading to chaotic markets on par with the GFC in 2008. To counter this volatility many of our funds maintain a structural long position in interest rate volatility, which supports performance in the portfolio through volatile periods. Transitioning to new market regimes or cycles is often accompanies higher rates volatility, causing RV relationships to shift into new trading ranges that are unfavourable for some existing positions but attractive for new positions. The use of conservative risk sizing and options helps limit the magnitude of potential losses in these environments. The periods after large market stress events can be good for RV as these disruptions often leave a lot of distortions as more macro orientated and passive investors focus on broader rates risk levels.

- Extreme low rates volatility, such as the recent Japan experience with yield curve control, is a more challenging environment – market rates expectations are so low and stable that market volatility collapses due to central bank intervention and the opportunity set becomes limited. Low volatility is unlikely to be a concern in 2024.

- RV alpha is structural, but the mix of opportunities changes with underlying market factors such as bond supply/demand dynamics. Changes in broader macro rates market environments influence the mix of RV trades. Examples include government bond issuance altering new issuance premiums and bond vs derivative basis during high fiscal deficit periods. We see these opportunities as positive for 2024.

Similarly, central bank asset programs, both QE and QT, can impact some RV opportunities for instance bond vs futures basis trades. These environments can support other more micro curve-oriented RV strategies (as central banks do not necessarily spread purchases or sales evenly across curves). Expectations of cash rate changes can influence hedging flows in particular segments of rates markets which can change yield curve shapes (steepen/ flatten) which can drive a change in investor flow which in turn impacts swap vs bond spreads. Economic data releases will ebb and flow, particularly in H1 2024, and tempt the market to price in and out expectations for interest rate adjustments and thereby flattening and steepening yield curves. These are opportunities we will seek to take advantage of in micro curve RV positions.

The stress in global interest rate relative value persists and is particularly noticeable in the EUR and UK markets. Metrics assessing stress in micro yield curve and bond RV are significantly elevated and are well above historical levels. We are continually taking advantage of these RV pricing relationships as they are unlikely to remain at these elevated levels indefinitely.

Read more insights from Ardea IM here.