Silent enablers of the global tech boom in Asia

Impax Asset Management

Authors: Paul Peng and Oscar Yang

It is no secret that Asian companies dominate many industries that form the cornerstone of the modern global economy. The region’s technology ecosystem has spawned consumer technology giants and pioneers in semiconductor-making, as well as leaders in key environmental technologies like electric vehicles (EVs).

A closer look at these industries reveals innovative Asian companies whose products and services are enabling the global technology boom. They include producers of flow regulators essential to the stable operation of electronics and providers of testing solutions for semiconductor makers.

Consumer technology product lifecycles are combining with structural trends to drive demand growth for smartphones and other devices, and the components like semiconductors that underpin them. In this context, we believe there are selective opportunities for long-term investors focused on the Asian technology sector.

Powerful engines of long-term growth

We are paying particularly close attention to three structural forces sustaining the growth of the Asian technology ecosystem: the electrification of personal mobility, emerging consumer electronics trends and the rapidly expanding semiconductor industry.

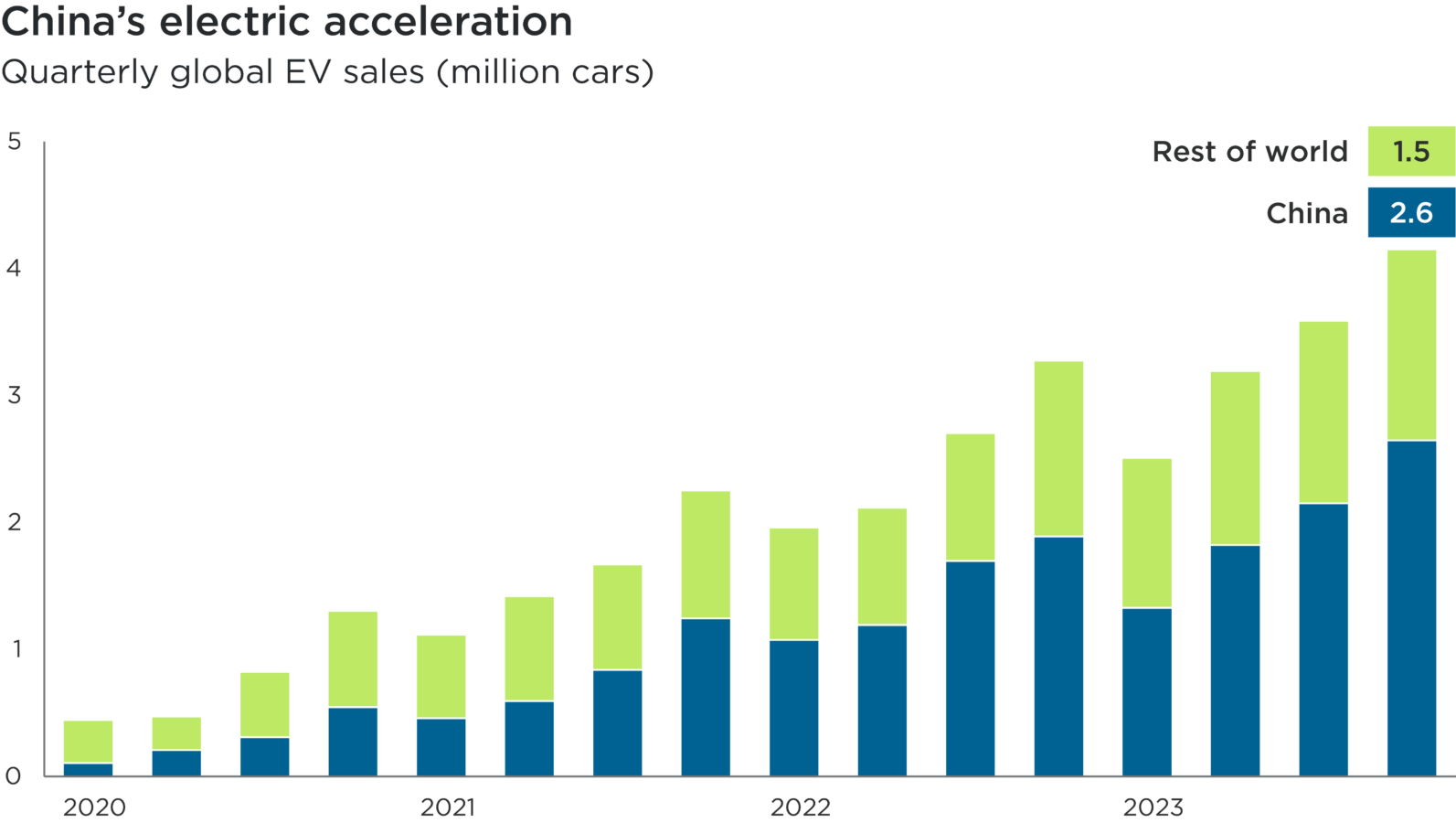

1. Demand for EVs is accelerating

Global EV sales rose by around one-third in 2023 and have quadrupled since 2020.1 Despite some short-term challenges for the sector since late 2023, global EV sales are forecast to grow by one-quarter this year.2 Longer-term, the compelling economics of EVs compared to internal combustion engines (ICEs), combined with national goals to decarbonise transport, should drive the electrification trend.

Source: Bernstein EV tracker, January 2024. Quarterly sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEV). Period from Q1 2020 to Q4 2023.

2. The consumer electronics market is poised for growth

Having stabilised in 2023, we expect global demand for consumer electronics to be fuelled by rising global smartphone adoption and contract renewals, and product innovation – including the incorporation of AI within devices.3 The market for established consumer devices is vast: more than 1.1bn smartphones were sold in 2023, as well as 247mn PCs and 135mn tablets.4

Meanwhile, emerging technology products continue to be brought to market. Virtual and augmented reality (VR and AR) headsets, for example, are moving into the mainstream with applications in gaming, education and healthcare. VR and AR hardware sales, estimated at a combined US$12bn in 2023, are projected to reach US$27bn by 2028.5

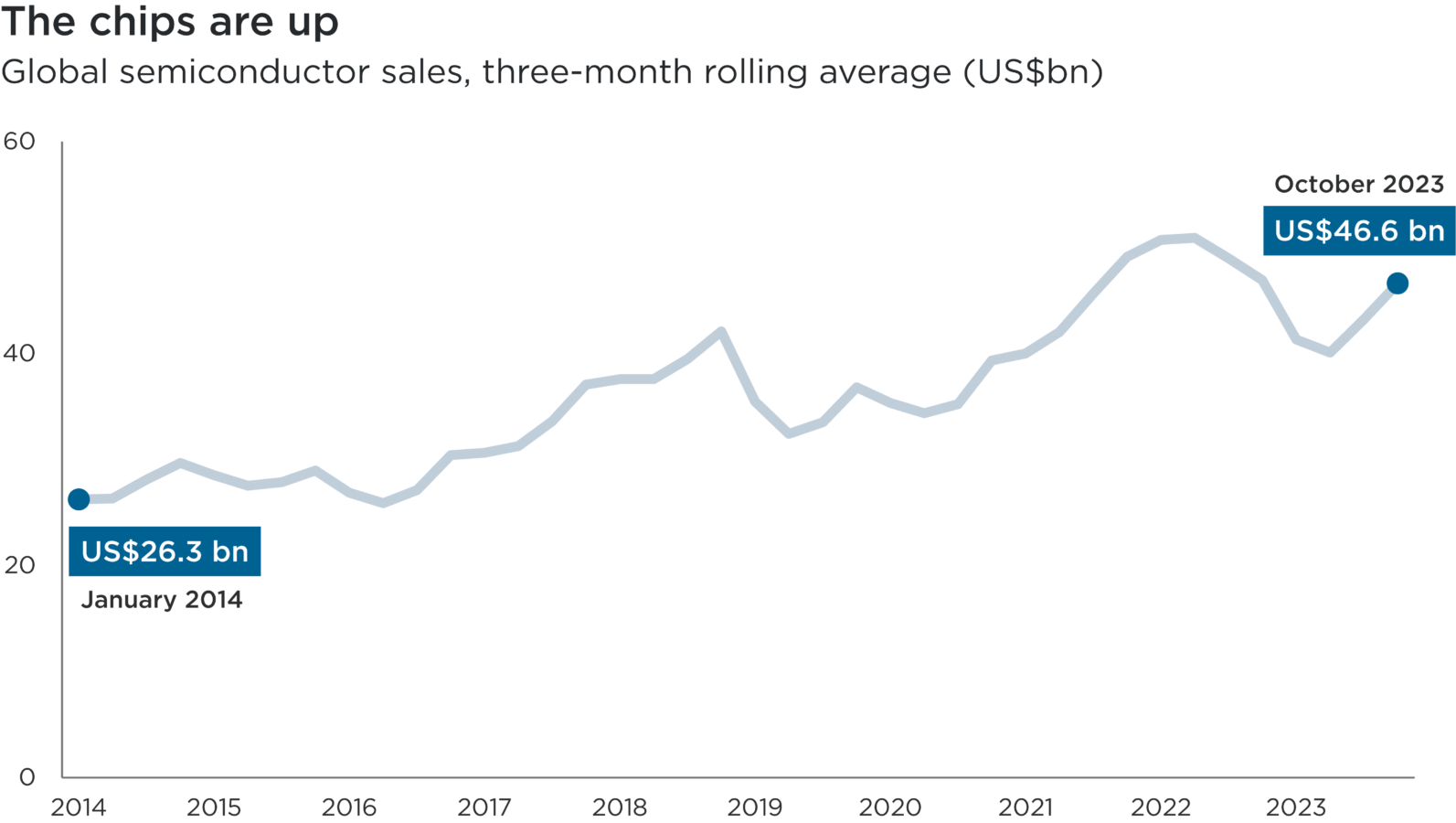

3. Semiconductor demand continues its upward trajectory

Though below their 2022 peak, global semiconductor sales have risen in value by almost 80% over the past decade.6 Demand growth has largely been fuelled by the rise of cloud computing and data storage, both of which require large numbers of energy efficient, high-bandwidth memory chips. AI, which is poised to disrupt many industries through the potential for automation, looks set to sustain demand growth from the data centres that power its processes. Overall, global semiconductor sales are forecast to grow by 7% a year this decade.7

Source: Semiconductor Industry Association, November 2023.

Innovative suppliers of niche technologies

There are three types of critical technology supplier that currently stand out, in our view, as well positioned to capitalise on these long-term structural trends: multilayer ceramic capacitors, suppliers to the semiconductor industry and makers of cutting-edge chips.

1. Multilayer ceramic capacitors (MLCCs)

Widely used in the automotive and electronics industries, MLCCs regulate the flow of electricity and prevent electromagnetic interference between components. They make up approximately 30% of the total components in a typical hybrid circuit.

Two companies, Murata and Samsung Electro Mechanics (SEMCO), together make up over 50% of the global MLCC market.8 Murata, a Japanese manufacturer of electronic components, is the leading supplier of MLCCs into the automotive industry by market share. As many as 5,000 MLCCs are used in each EV to ensure the stable operation of various electrical and electronic circuits.9 The advent of automated driving features will lead to a further increase in the need for MLCCs.

Its South Korean peer, SEMCO, has traditionally been more focused on supplying MLCCs to the consumer electronics and telecommunications industries.10 The latest smartphones contain between 800 and 1,000 MLCCs, some as small as one-eighth of a millimetre in diameter. The miniaturisation of MLCCs continues to be key to smartphones becoming more powerful, but not necessarily larger. SEMCO has recently also increased its market share in the automotive market, which contributes more than 20% of revenues.11

2. Niche suppliers to the fast-growing semiconductor industry

Hoya, a Japanese maker of optical healthcare products like contact lenses and eyeglass lenses, is also a leading supplier of glass components critical to chipmaking. Hoya’s advanced mask blanks and photomasks are used to transfer the tiny, highly complex circuit patterns for semiconductors onto the silicon wafers that become chips. Its extreme ultraviolet lithography masks are used to develop chips with greater circuit density, and so higher computational power.

Taiwan-listed company Chroma ATE, meanwhile, is a leading provider of testing solutions for the electronics and semiconductor industries. Chroma’s services include high-speed digital testing and high-performance power source and complementary metal-oxide-semiconductor image sensor testing – a critical step in ensuring the functionality, reliability and performance of integrated circuits. The company is also exposed to the AI megatrend: Chroma’s innovative system-level testing equipment is a key enabler for AI training chips such as graphics processing units (GPUs), which are critical to generative AI technologies.

3. Innovative manufacturers of cutting-edge semiconductors

SK Hynix produces around half of the world’s high-performance high-bandwidth memory (HBM) chips, which offer faster and more energy-efficient data processing.12 Initially used in gaming graphics cards, the latest HBM chips are seen as critical to training AI models. HBM chips are made of vertically interconnected dynamic random access memory (DRAM) chips, for which the South Korean company boasts about a one-third market share.13 Other users of HBM and DRAM chips include the data centres that power cloud computing, which is more efficient than on-premise computing. SK Hynix is also a leading manufacturer of NAND flash memory chips which are predominantly used in smartphones, diversifying its end markets further.

Cyclical drivers of growth

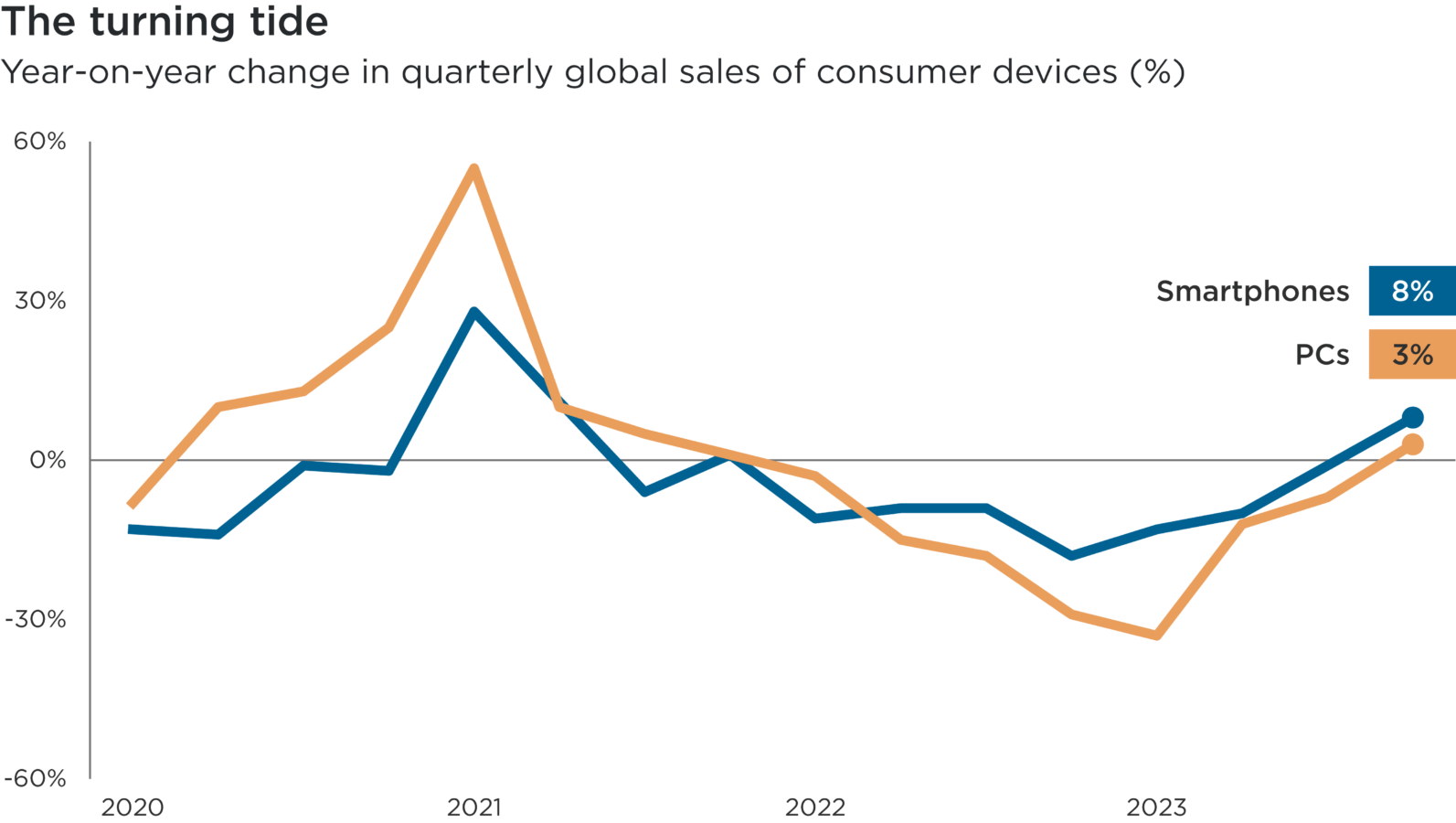

All technology has a lifecycle as hardware either becomes outdated or obsolete, or in some cases ceases to operate altogether. While this provides baseline demand for goods and, by extension, components like semiconductors, purchases of consumer devices follow a cycle that indicators suggest is now ticking upward.

The current demand trend was instigated by the COVID-19 pandemic, when millions brought forward smartphone purchases and upgrades during the lockdowns of 2020 and 2021. Likewise, purchases of PCs spiked as employees and employers adapted to enforced working from home. As the chart below shows, demand for smartphones and PCs – reasonable bellwethers for the broader consumer technology sector – fell year-on-year throughout 2022 and 2023.14

Given that the average replacement life of a smartphone is between three and four years, demand growth has turned positive as pandemic-era models come up for replacement and more consumers look to upgrade to 5G-capable handsets.15 Demand for personal computers, which tend to have slightly longer average lifespans, is also now rising for the first time in two years.16

Source: Canalys estimates, January 2024. Period from Q1 2020 to Q4 2023. PCs includes desktops and notebooks.

A window of opportunity

Asia boasts a large and growing number of companies that command niches in fast-growing areas of the new economy. What’s more, their focus on technological innovation and leadership provides these companies with high barriers to entry and can help protect profit margins.

We believe this moment in the consumer technology lifecycle offers a compelling opportunity for Asian companies that support pivotal technologies in the modern global economy. Where those solutions contribute to addressing global environmental challenges, they and their investors stand to benefit from powerful long-term structural trends.

1 Bernstein EV tracker, January 2024

2 Bernstein EV tracker, January 2024

3 Statista, February 2024: Consumer Electronics – Worldwide

4 Canalys, January 2024: Consumer tech

5 Statista, 2023: AR & VR – Worldwide

6 Semiconductor Industry Association, November 2023

7 McKinsey, 2022: The semiconductor decade: A trillion-dollar industry

8 Murata / Samsung Electro Mechanics, January 2024

9 Murata, 2021: Automotive MLCCs Balancing Reliability with Miniaturization and High Capacitance in a Closely Intertwined Evolution with the CASE Trend

10 Samsung Electro Mechanics, January 2024: SEMCO Q4 2023 Earnings Results

11 Samsung Electro Mechanics, January 2024: SEMCO Q4 2023 Earnings Results

12 Davies, C., & Jung-a, S., 29 July 2023: SK Hynix and Samsung’s early bet on AI memory chips pays off. Financial Times

13 Choi, J., 24 November 2023: SK Hynix Achieves Record 35% Market Share in DRAM in Q3. BusinessKorea

14 Canalys estimates, January 2024

15 Bloomberg Intelligence, May 2023: Smartphone providers await 2H smartphone rebound

16 Canalys estimates, January 2024