Why is the U.S. “Middle Market” Important?

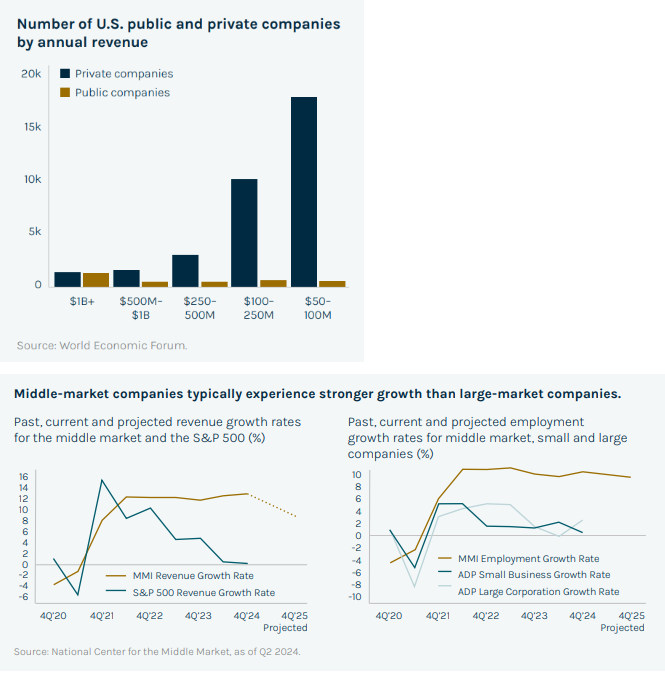

There are ~200,000 midsize U.S. companies with 100+ employees1

- Collectively, they represent ~1/3 of U.S. economic output

- Same size by output as Germany or Japan

- 99% of them are private

These midsize companies are the U.S. “middle market”2 and make up the beating heart and soul of the U.S. economy.

The vast majority of these companies are private, not publicly traded. This means that they cannot be accessed through traditional ETFs or mutual funds, but only through private equity and private credit investments.

In this piece, we highlight this important component of the U.S. economy and its relevance to the U.S. investment landscape.

1. Source: Capital IQ as of January 2022. “Large market” includes companies >$100M in revenues. National Center for the Middle Market, as of Jan 1, 2024.

2. “Middle market” includes companies with $10 million to $1 billion in annual revenue.