Introduction to Collateralised Loan Obligations (CLOs)

A CLO is a type of structured finance product which is backed by a diversified pool of corporate loans. These are typically loans to businesses with sub-investment grade credit ratings. When a CLO is issued, a large number of loans are packaged together, structured into tranches with varying credit ratings and then sold to investors in the market. The principal and interest payments on a CLO are paid from the cash flow generated by underlying loans. This structure is similar to other asset-backed securities, however there are a few key differences between CLOs and other ABS products.

How are CLOs structured?

A key differentiator of CLOs from other ABS structures is that they are not issued by the originator of the loans. Rather, they are issued by CLO managers – firms which specialise in the credit underwriting and monitoring of these loans. To issue a CLO, a CLO manager will purchase a large number of corporate loans, diversified across company size, industry and geography. These corporate loans are often referred to as “leveraged loans1 ” and are usually senior secured, pay a floating rate coupon and hold sub-investment grade ratings. CLOs may also contain a small amount of high yield bonds with fixed or floating rate coupons.

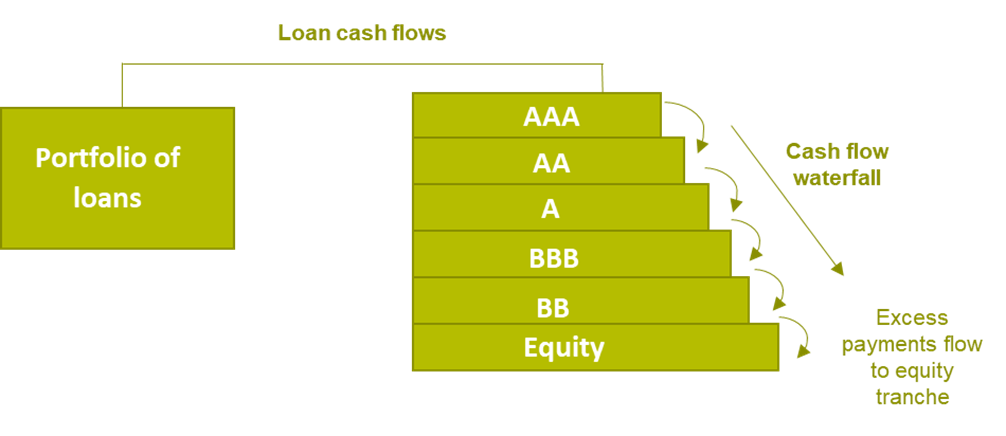

These loans (and bonds) are pooled together in a special purpose vehicle (SPV) and structured into tranches of interest-paying bonds with differing levels of risk and return (senior and mezzanine tranches) and a small portion, typically 10%, of equity (junior tranche). The tranches receive cash flow distributions generated from the underlying loan pools in order of seniority. The most senior tranche offers the lowest yield but is the first to receive payments and carries the lowest amount of credit risk. Mezzanine tranches offer higher returns but are more exposed to credit losses. The junior or equity tranche offers the highest expected returns but is last to receive repayments and so first to absorb any losses. These lower tranched bonds are only paid after each higher tranche has been paid its full distribution, and distributions to the equity tranche come from excess interest and principal payments generated by the collateral pool. This cascading flow of payments between bonds is commonly referred to as a “waterfall” structure. Investors who receive periodic interest payments and the return of principal on the tranched bonds as the loan pools are repaid.

Another key feature of CLOs is that collateral pools are typically not static and are actively managed by CLO managers. The manager continually monitors the credit quality and performance of underlying loans and will trade loans in and out of the portfolio. This allows the manager to optimise portfolio returns and manage risk, as well as generate sufficient cash flows the meet the payment obligations to CLO investors.

CLO cash flow diagram

Benefits of Investing in CLOs

Favourable risk-return dynamics: CLOs can offer an attractive spread premium over corporate bonds of the same credit rating. The premium compensates investors for some of the risks detailed below. However, we note that post GFC, the CLO market has grown in size to be over USD1.2trn with increasing liquidity as a part of global Fixed Income markets.

Diverse risk-return opportunities: CLOs offer varying risk profiles to suit different investor preferences, spanning AAA to equity-like risks and returns. CLOs are also issued with a range of reinvestment periods, from 5yr reinvestment periods typical in US Broadly Syndicated CLOs to shorter 1-3yr reinvestment periods and even static portfolios, as issuers look to match investor demand.

Short interest rate duration: Most CLOs are floating rate, offering higher returns as interest rates rise and minimal interest rate risk compared to traditional fixed income.

Solid performance: The CLO market saw much lower levels of credit stress during the GFC compared to the widely known issues within the CDO market. Post GFC, S&P notes that across the 18,599 rated tranches of CLO 2.0 transactions (transactions originated in post 2010), to date, 20 tranches of early vintage U.S. CLO 2.0s have defaulted. There has been no defaults within EUR CLO 2.0s. Between 1993-2022, material impairments were 0.5% and 0.3% of US and European CLOs respectively.

CLO Risks

CLOs are complex structured securities and involve several risks, including:

Credit risk: Given the underlying assets of CLOs are corporate loans made to non-investment grade borrowers they inherently carry an increased risk of default than investment grade borrowers. Underlying loan defaults negatively impact the CLO portfolio performance as losses erode the credit enhancement in the structure for CLO bonds. A CLO investor should have a detailed understanding of the credit quality of the underlying loans and ensure the CLO manager is properly managing credit risk in the portfolio.

Market risk: The value of the underlying loans and CLOs themselves can be affected by broader market conditions including the economic environment and investor sentiment.

Liquidity risk: While CLOs tend to exhibit healthy trading liquidity, in periods of market volatility liquidity may be challenged. Investors should be comfortable with the liquidity characteristics of CLOs during different market environments. Liquidity and secondary volumes have increased as the market has grown over the last decade.

Prepayment risk: CLO bonds typically have a non-call period of 1-2yrs. After this point, the bonds are callable at the option of the issuer/equity in the CLO transaction which can lead to early prepayment or refinancing of the CLO bond(s). In addition, the underlying loan portfolio borrowers may choose to repay their loans early, impacting the expected cash flows and potentially the return from a CLO. Experienced CLO managers may use cash flow modelling to anticipate and mitigate the impact of prepayment.

Reinvestment risk: Part of CLO bond and loan pool management involves reinvesting the proceeds of loan sales or repayments into other loans to maximise portfolio performance. There is a risk that the proceeds will be reinvested in loans with lower yields than previously, reducing returns for CLO investors.

Complexity: CLOs have complex structures. Investors must understand the specific terms and conditions and credit profile of underlying loan collateral as well as the specific CLO structure including waterfall mechanism and credit enhancements to make informed investment decisions.

Interest rate risk: While most CLOs are floating rate, meaning their prices are not directly impacted by rising or falling interest rates, the interest paid on the CLO will change as interest rates move up or down.

Risk management in CLOs

There are several risk management features of CLOs to help protect investors:

Professional management: CLOs are actively managed by experienced asset managers who are specialised in credit underwriting. CLO managers have relevant experience in credit analysis, portfolio management and financial product structuring and apply financial modelling and stress testing to evaluate and manage the risks present in CLOs.

Alignment: CLOs which comply with European Securitisation Regulation require a 5% risk retention by the CLO originator or sponsor, helping to align manager and/or equity holder interests with those of investors.

Collateral diversification: Collateral concentration restrictions help to limit the risk of loss by requiring the underlying loans to be sufficiently diversified across industries, geography, company size and credit ratings.

Credit enhancements:

- Subordination: The ranking of different CLO tranches in order of priority of payment means that lower tranches absorb losses, protecting more senior tranches. Due to this structure, the value of a CLO can decline significantly before investors in the upper tranches begin to take losses.

- Overcollateralisation: The face value of the loans in the underlying pool must exceed the face value of the CLO debt tranches. If the value of the loan collateral declines below the value of debt issued, cash flows that would have been paid to the equity tranche will be used to ensure principal value can be paid back to debt tranches.

- Excess spread: The interest collected from the underlying loans is higher than the interest paid to CLO debtholders, providing a buffer against losses. If the interest income is not sufficient to meet the required interest payments on the debt tranches, cash flows will be diverted away from the equity tranche to the more senior tranches.

History and Evolution of CLOs

CLOs were first developed in the 1980s and 1990s, with the structure remaining relatively unchanged until the Global Financial Crisis (GFC) in 2008. CLOs performed relatively strongly during the GFC and proved much more resilient than CDOs, for example, which exhibited high levels of default in senior tranches. Across the 5,797 tranches rated by S&P across CLO 1.0s (transactions originated pre GFC), only 62 tranches defaulted, and no losses occurred on a senior tranche of a CLO.

Since 2009, increased regulatory scrutiny on securitised products has seen the regulation and structure of CLOs evolve. Changes have been focused on strengthening credit support and reducing risk to better protect debt tranches.

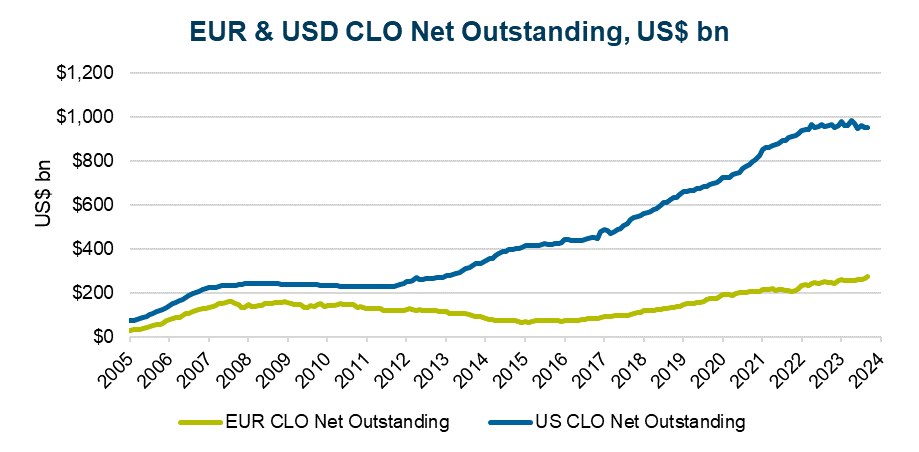

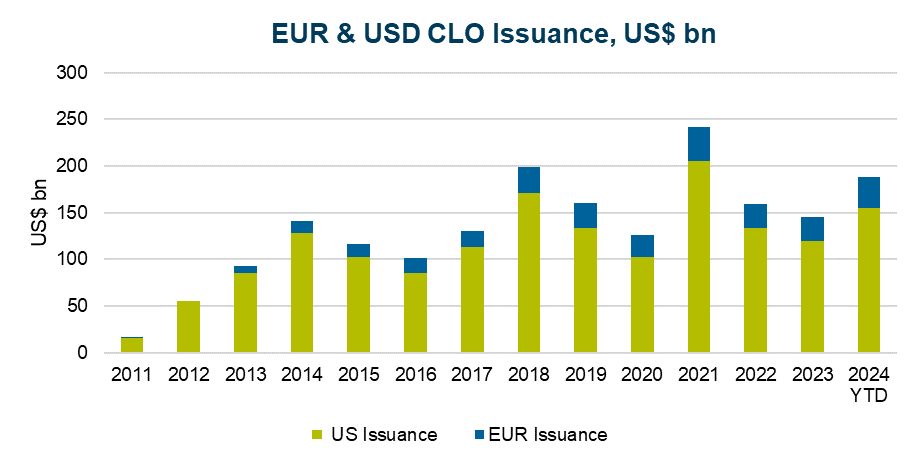

The CLO market has grown consistently since the GFC and is today over US$1tn in size in the US and over US$220bn in Europe. 2024 will be the largest year of issuance since the 2021 post-pandemic macro recovery. Net supply across US and European CLOs remains stable as the volume of transactions repaid has been elevated due to the current spread environment which encourages refinancing. We note this net supply as being a strong technical for the market together with the strong reinvestment need from existing investors and new entrants to the market.

Source: Citigroup

Source: Morgan Stanley Research

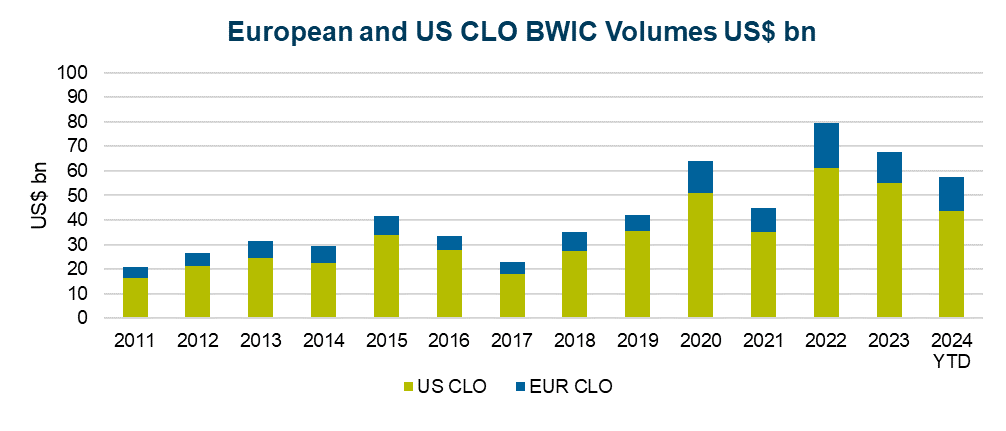

With the expansion of the market, liquidity for US and European CLOs has improved in recent years and trading volumes have increased to a healthy level. Annual BWIC (bond auction) volumes are sufficiently high relative to market size. Furthermore, the market has maintained liquidity during periods of market stress such as the 2022 LDI crisis.

Source: JP Morgan

In addition to CLOs with collateral pools of broadly syndicated loans, the US CLO market has developed further in recent years to feature CLOs with portfolios of middle market/private credit loans as the underlying collateral (MM CLOs). Generally, these are directly originated loans to smaller, unrated companies with EBITDAs ranging from US$10-100mn. While still a smaller part of the US CLO universe, over recent years MM CLOs have become a material portion of the US CLO market, representing ~20% of new issue CLO volume during 2024 and over 10% of the broader US CLO market. Although the market is not yet established in Europe, the first MM CLO was issued in Europe in Q4 2024 and expectations are for further issuance to come.

Challenger IM Fixed Income has a long pedigree in origination, structuring, servicing and investment in securitised markets, CIM invests in Investment grade rated tranches of CLOs backed by broadly syndicated leveraged loans or middle market loans.

1The loans are often utilised by private equity firms to facilitate the purchase of acquisition targets. The loan allows the private equity sponsor to increase or ‘leverage’ their available capital to complete the purchase.

Important Information

This material has been prepared by Challenger Investment Partners Limited (Challenger Investment Management or Challenger), ABN 29 092 382 842, AFSL 329 828.

This document does not relate to any financial or investment product or service and does not constitute or form part of any offer to sell, or any solicitation of any offer to subscribe or interests and the information provided is intended to be general in nature only. This should not form the basis of, or be relied upon for the purpose of, any investment decision. This document is not available to retail investors as defined under local laws.

This document has been prepared without taking into account any person's objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting.

This document is provided to you on the basis that it should not be relied upon for any purpose other than information and discussion. The document has not been independently verified. No reliance may be placed for any purpose on the document or its accuracy, fairness, correctness, or completeness. Neither Challenger Investment Management nor any of its related bodies corporates, associates and employees shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of the document or otherwise in connection with the presentation.