About the Fund

The Challenger IM Global Asset Backed Securities (ABS) Fund is a long-only global asset-backed securities fund, focusing predominantly on investment grade publicly rated assets across developed markets. The Fund builds upon Challenger IM’s scale, track record and experience in global securitisation markets and managing credit investment strategies. The Fund’s income-based strategy is designed to provide incremental returns without speculating on interest rates or currencies. Its relative value approach across global securitisation markets allows the Fund to achieve higher returns and better diversification including accessing attractive opportunities in private securitisation markets.

Why This Fund

The Challenger IM Global Asset Backed Securities (ABS) Fund is a long-only global asset-backed securities fund, focusing predominantly on investment grade publicly rated assets across developed markets. The Fund builds upon Challenger IM’s scale, track record and experience in global securitisation markets and managing credit investment strategies. The Fund’s income-based strategy is designed to provide incremental returns over fixed income strategies without speculating on interest rates or currencies. Its relative value approach across global securitisation markets allows the Fund to achieve higher returns and better diversification. The Fund will also access attractive opportunities in private securitisation markets.

Investment Objective

The Fund aims to seek a return for shareholders generated from income and capital appreciation.

Fund Facts

- Max exposure to CLO Bonds - 40%

- Max sub-investment grade - 15%

- Max externally unrated - 15%

- Max exposure to single obligor - 5%

- Average rating A-/BBB+

For full details see ICAV Prospectus and Fund Supplement

Class N USD Hedged Accumulating

Class N EUR Hedged Distributing

Class N AUD Hedged Distributing

Class X USD Hedged Accumulating

Class X GBP Hedged Accumulating

Class X EUR Hedged Distributing

Class X AUD Hedged Distributing

Class A USD Hedged Accumulating

Class A USD Hedged Distributing

Class A GBP Hedged Accumulating

Class A EUR Hedged Distributing

Class A AUD Hedged Distributing

Class A: 0.50%

Class N: 0.00%

| BHP GROUP LIMITED |

| COMMONWEALTH BANK OF AUSTRALIA |

| CSL LTD |

| NATIONAL AUSTRALIA BANK LIMITED |

| WOODSIDE ENERGY GROUP LTD |

| MACQUARIE GROUP LIMITED |

| WOOLWORTHS GROUP LTD |

| WESTPAC BANKING CORPORATION |

| GOODMAN GROUP |

| TELSTRA CORPORATION LIMITED |

Asset-backed Securities

What is ABS?

Asset-backed securities (ABS) are a type of structured credit investment where securities are backed by underlying pools of assets such as mortgages, loans or other corporate or consumer debt of varying types. The underlying assets are usually those that generate a scheduled cash flow which provides the interest and principal payments of income from the asset-backed securities. ABS make up a significant part of the fixed income universe and are a way for both banks and non-bank lenders to fund their lending portfolios. Loan originators group similar assets together, securitise them and sell the ABS to investors in the market. ABS may be structured into different tranches with different credit ratings; the senior tranche is usually AAA or AA rated with subordination provided by mezzanine and equity tranches.

Why ABS?

- Favourable risk return dynamics: ABS offers a typically higher yield than similarly rated corporate credit as a result of its lower liquidity (illiquidity premium) and high barriers to entry given the need for specialised skillset and resources

- Wide breadth of opportunities: relative value opportunities exist across geographies, asset classes and capital structure

- Diverse set of underlying collateral types across developed markets

- Opportunity set spans AAA to equity risks

- Opportunities exist across both public and private markets

- Diversification from corporate credit: predominately floating rate investments with shorter credit expected repayment windows, reducing market sensitivity

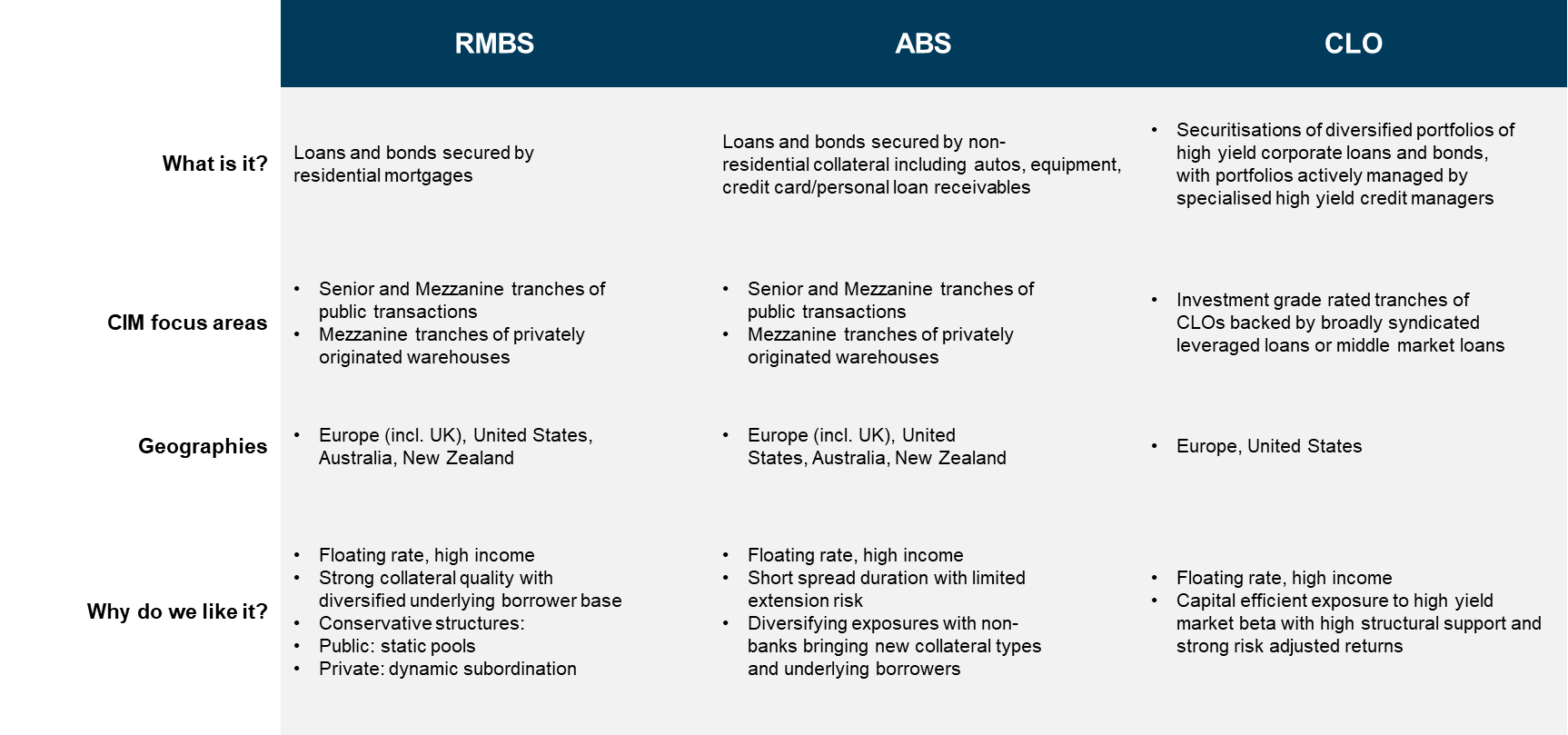

Types of ABS

Ways to Invest

If you are interested in investing in the Challenger IM Global ABS Fund, please contact us via email.