Since its inception in the 1970’s, the global asset backed securities market has evolved beyond mortgage-backed assets to include loans secured by autos, equipment, credit card/personal loan receivables as well as high yield corporate loans. As the range of investment opportunities has grown, there is an opportunity for enhanced yield compared to similarly rated corporate credit.

Market standards are higher following lessons learned across markets through GFC.

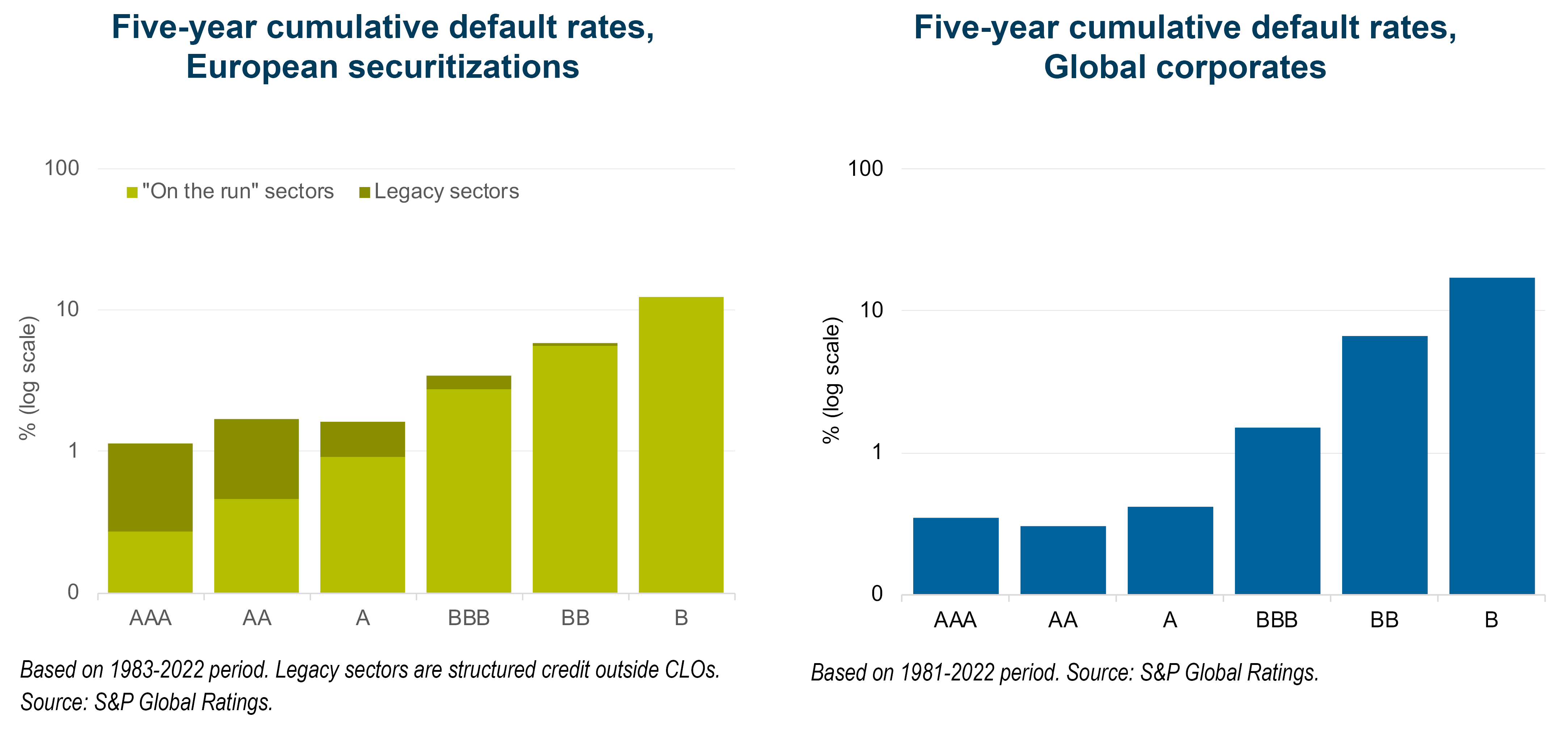

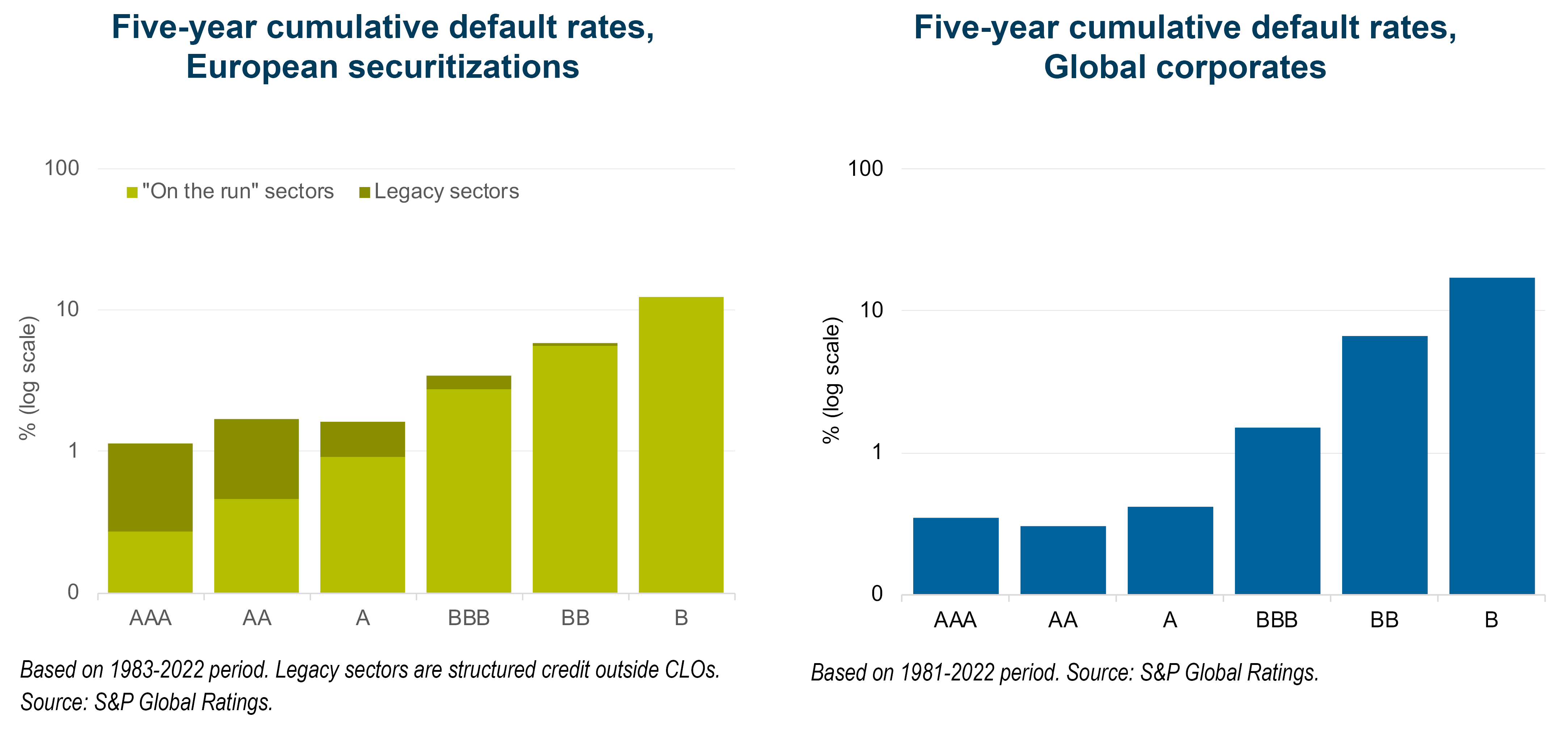

Pre-Global Financial Crisis (GFC), risks in the subprime mortgage and CDO markets were generally underappreciated by the market. More than a decade on, lessons learnt in these markets have been incorporated more widely across ABS sectors and deal structures which have improved markedly, resulting in significantly lower credit risk. In fact, long term default rates are similar to corporate credit when adjusting for legacy sectors, as shown in the chart below. Yet, this asset class often remains overlooked. What is sometimes less understood is the lessons that have been learned and implemented.

- Underwriting standards for the underlying loan pool have improved significantly and structural enhancements have taken place. For example, assets are tested to withstand severe stress scenarios with higher rated tranches subject to more stringent requirements.

- Increased oversight by global regulatory bodies has led to better transparency and standardisation.

- Loan data and performance data is more widely available.

Following the GFC, global regulatory bodies established a framework of rules intended to prevent excessive risk taking within the banking, insurance and pension fund ecosystems, a byproduct of which increased the cost and decreased the availability of asset backed capital within these ecosystems. This has allowed alternative financiers to step in to fill the gap.

Time to consider ABS?

The global asset backed securities market provides investors with high quality, yield enhancing and diversifying investment opportunities.

- Low duration: Most ABS securities issued in European and Australian markets are floating rate which means not only higher returns in a rising rate environment but also lower duration relative to traditional fixed income.

- Shorter repayment: Typically, repayments are within 1 to 5 years, much faster than traditional corporate credit exposures. This reduces the underlying volatility and correlation of asset backed finance with traditional growth assets as well as traditional fixed income products due to the insulation from interest rate and credit spread duration risk.

- Diversification and niche market opportunities: With a broad range of asset classes, capital structures, underlying collateral types and jurisdictions, relative value opportunities continually present themselves as the performance outlook and investor appetite across sectors change. The breadth of securitisation markets also gives rise to attractive niche markets, such as the Australian non-bank mortgage market. Despite being relatively niche, the opportunities in these markets can be significant and provide attractive relative value for investors who have access to them.

The UK LDI crisis in September 2023 was a prime example of when this combination of floating rate, short duration and a robust performance outlook presented a compelling opportunity for asset managers. Many were able to carry out large sales of highly rated securitised bonds at relatively low discounts to par. This experience stood in stark contrast with more traditional long duration fixed income instruments which experienced large capital losses and consequently extreme illiquidity during this period. We estimate that over a 3-week period roughly $15 billion in securitised bonds traded, a telling demonstration of demand for the asset class and also, the liquidity available.

The complexity of the asset class does necessitate specialised investment management. Deep experience and expertise is a pre-requisite. Underwriting a corporate borrower is a very different skillset to underwriting a highly granular and diversified pool of collateral. In addition to making an assessment on the credit risk of the investment, it is essential to understand how the cashflows from the collateral will pass along a bespoke cashflow waterfall structure. The reticence and underweight allocation to securitised assets from some investors creates a bigger opportunity for those that understand the asset class and its evolution.

Challenger IM Global ABS Fund

The Challenger IM Global ABS Fund is available to institutional investors to extend CIM’s existing range of products which aim to exploit inefficiencies in the pricing of credit risk across public and private markets. To date, all funds have invested across corporate, securitised and real estate backed credit, targeting gross returns of between 3% and 8% per annum over cash. The CIM Global ABS Fund is CIM’s first offering which provides dedicated access to securitised credit. With over A$9 billion (as at 31 December 2023) invested in securitisation markets, investment experience dating back to 2005 and 14 investment professionals dedicated to ABS investing, the team has developed a strong edge in this relatively niche part of the credit landscape.

The Fund will target a 3-4% per annum through the cycle return before fees over the Euro Short Term Rate by investing predominantly in publicly rated investment grade opportunities across global developed securitised markets, with a particular focus on Europe, UK, Australia and opportunistically in the US. By selectively blending attractive private market opportunities with public market transactions, the Fund will offer incremental yield in addition to diversification away from more traditional strategies. It will focus on floating rate assets with exposure to interest rate and currency hedged.

About Challenger Investment Management

Challenger Investment Management ‘CIM’ was established in 2005 and has a strong investment background in the less liquid parts of the global developed credit markets. The Fixed Income team is focused on accessing investment opportunities across a broad spectrum of fixed income credit markets and believes that high income, diversifying and defensive portfolios can be constructed by taking a multi- strategy approach to credit investing across both public and private markets. By having a broad mandate and incorporating both public and private sector credit, the team seeks to identify and benefit from pricing inefficiencies across credit, liquidity, and complexity risks. The team looks to dampen volatility by seeking to avoid interest rate and currency risks and aims to keep spread duration relatively short, particularly for less liquid strategies.

Glossary

| CDO |

Collateralised Debt Obligation |

CDO’s are a complex structured finance product that is backed by a pool of loans and other assets and sold to institutional investors. |

| LDI |

Liability-Driven Investment |

LDI is an approach that focuses the investment policy and asset allocation decisions on matching the current and future liabilities of the pension plan. LDI can effectively manage portfolio risk and help minimise the impact of the pension plan on the sponsor’s financial health. |

| ABS |

Asset-Backed Securities |

A type of financial investment that is collateralised by underlying pool of assets – usually ones that generate a cash flow from debt, such as loans, leases, credit card balances, or receivables. |

Important Information

This document is prepared by Challenger Investment Partners Limited (ABN 29 092 382 842, AFSL 234678) (Challenger Investment Management or Challenger) the investment manager of the Challenger IM Global Asset Backed Securities Fund (Fund). The Fund is a sub-fund of the FundRock QIAIF Platform I ICAV (ICAV).

In the United Kingdom and Canada this document is issued and approved by Fidante Partners Europe Limited (“Fidante Partners”). Fidante Partners is authorised and regulated by the Financial Conduct Authority in the conduct of investment business in the United Kingdom. In the European Union this document is issued and approved by Fidante Partners AB (“Fidante Sweden”).

Fidante Sweden is an investment firm authorised by the Swedish Financial Supervisory Authority (Finansinspektionen). Fidante Sweden is authorised to provide investment advice, reception and transmission of orders and execution of orders on behalf of customers. Fidante Partners and Fidante Sweden are subdistributors of the Fund and are issuing in this capacity only. Fidante Partners, Fidante Sweden and Challenger Investment Management are members of the Challenger Limited group of companies (Challenger Group). Information is intended to be general only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the information is suitable to your circumstances.

In Australia, this document is issued by Challenger and the minimum investment amount in Australia is A$500,000. Unless otherwise stated, we do not guarantee any particular investment return, or the capital invested. We have taken reasonable care to ensure that any facts stated are accurate and any opinions given are on a reasonable basis, however you should take your own advice on the merits of these facts or opinions.

In preparing this information, we have in part relied on publicly available information and third-party sources believed to be reliable, however the information we provide has not necessarily been independently verified or audited. No part of this presentation may be reproduced or distributed in any manner without prior written permission of Challenger.

The information and opinions contained in this document are for background purposes only and do not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by Fidante or any of its affiliates or any vehicle and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. Past performance is not a reliable indicator of future performance.

This document is for information purposes only and does not constitute or form part of, and should not be construed as, an offer, invitation or inducement to purchase or subscribe for any units in the Fund nor shall it or any part of it form the basis of, or be relied upon in connection with, any contract or commitment whatsoever. It also does not constitute a recommendation regarding any investments. Recipients of this document who intend to apply for shares or interests in the Fund are reminded that any such application may be made solely on the basis of the information and opinions contained in the prospectus or other offering document relating thereto, as and when they become available, which may be different from the information and opinions contained in this document.

The investments have not and will not be registered for sale, and there will be no public offering of the units. No offer to sell (or solicitation of an offer to buy) will be made in any jurisdiction in which such offer or solicitation would be unlawful.

Any forward-looking statements included in this presentation involve subjective judgment and analysis and are subject to significant uncertainties, risks and contingencies, many of which are outside the control of, and are unknown to, Challenger. They speak only as of the date of these materials, and they are subject to significant regulatory, business, competitive and economic uncertainties and risks. Actual future events may vary materially from forward looking statements and assumptions on which those statements are based.

Given these uncertainties, recipients are cautioned not to place undue reliance on such forward-looking statements. Historical returns are no guarantee of future returns and are not a reliable indicator of future performance. The money invested in the Fund can both increase and decrease in value and it is not certain that you get back all the invested capital. If you are in any doubt about the suitability of investing, you should seek independent advice. There are no entry or exit fees for the Fund.

UK investors only

This document is a financial promotion for the purposes of the Financial Services and Markets Act 2000 (FSMA) and has been issued for the sole purpose of providing information about the Fund. This document is issued in the United Kingdom only to and/or is directed only at persons who are of a kind to whom the Fund may lawfully be promoted by virtue of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (including authorised persons, high net worth companies, high net worth unincorporated associations or partnerships, the trustees of high value trusts and certified sophisticated investors). This document is exempt from the general restriction in Section 21 of FSMA on the communication of invitations or inducements to participate in investment activity on the grounds that it is being issued to and/or directed at only the types of person referred to above. Shares or interests in the Fund are only available to such persons and this document must not be relied or acted upon by any other persons.

European Union

In the European Union and the European Economic Area, this document is available to Professional Clients (as defined under Annex II to Directive 2014/65/ EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/ EU).

The United States

This document is issued in the United States by Challenger Management Services (UK) Limited (CMS), the sub-manager of the Fund. This document does not contain or constitute, and should not be construed as, an offer to sell or the solicitation of an offer to buy securities in the United States. The shares of the Fund or the ICAV have not been approved or disapproved by the US Securities and Exchange Commission (SEC) or by any securities regulatory authority of any state or of any other US or non-US jurisdiction, nor has the SEC or any such securities regulatory authority validated the accuracy or adequacy of this document or of any prospectus of the ICAV. Any representation to the contrary is a criminal offense. The shares have not been registered under the US Securities Act of 1933, as amended (Securities Act), the securities laws of any US state or any other US or non-US jurisdiction, and such registration is not contemplated.

If offered in the United States, shares will be offered and sold in the United States under the exemption provided by Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder and other exemptions of similar import in the laws of the states and jurisdictions where the offering will be made. The shares may be offered outside the United States in reliance upon the

exemption from registration provided by Regulation S promulgated under the Securities Act. The ICAV, and accordingly each sub-fund of the ICAV (each, a Sub-Fund), will not be registered as an investment company under the US Investment Company Act of 1940, as amended (Investment Company Act) as the ICAV, and accordingly each Sub-Fund, intends to rely on the provisions of Section 3(c)(7) of the Investment Company Act to avoid requirements that it register as an “investment company” under, and comply with the substantive provisions of, the Investment Company Act. In connection with each Fund’s reliance on Section 3(c)(7) of the Investment Company Act, each investor must be a “qualified purchaser” (as such term is defined in the Investment Company Act and the SEC rules promulgated thereunder). Consequently, investors will not be afforded the protections of the Investment Company Act. There is no public market for the shares and no such market is expected to develop in the future. The shares may not be sold or transferred (i) except as permitted under the ICAV’s applicable governing documents and (ii) unless they are registered under the Securities Act and under any other applicable securities laws, or an exemption from such registration thereunder is available.

Challenger Investment Management | March 2024 | Market evolution: Investing in Asset Backed Securities. FundRock Management Company

S.A. or any successor(s) thereto appointed by the ICAV as alternative investment fund manager (AIFM) is exempt from registration with the US Commodity Futures Trading Commission (CFTC) as a commodity pool operator (CPO), with respect to the ICAV, and accordingly the Fund, pursuant to CFTC Regulation 4.13(a)(3). The AIFM may in the future rely on the relief from registration as a CPO set forth in CFTC Staff Letter 12-38.

Regulation 4.13(a)(3) is available to operators of pools (and of feeder funds that invest in pools) that trade a de minimis amount of commodity interests (which includes futures, options on futures and certain swaps). In order to qualify for the exemption, the Fund’s trading in commodity interests will be limited such that, at all times, either (a) the aggregate initial margin and premiums required to establish commodity interest positions do not exceed five percent (5%) of the liquidation value of the Fund’s investment portfolio or (b) the aggregate net notional value of the Fund’s commodity interest positions does not exceed one hundred percent (100%) of the liquidation value of the Fund’s investment portfolio. Consequently, unlike a registered CPO, the AIFM is not required to provide investors in the shares with a disclosure document or a certified annual report meeting the requirements of the CFTC regulations otherwise applicable to registered CPOs. Neither this document, any prospectus of the ICAV nor the Supplement for the Fund has been and is not required to be filed with the CFTC, and the CFTC has not reviewed or approved this document, any prospectus or the offering of the shares.

Canada

This information is provided in Canada for “Permitted Clients” only, as defined under relevant Canadian laws. This information is not, and under no circumstances is to be construed as, a public offering of securities or an offering of securities in any jurisdiction in which such offering would be unlawful. No securities commission or similar authority in Canada has in any way passed upon the merits of the interests offered hereby and any representation to the contrary is unlawful. Persons who will be acquiring interests pursuant to this memorandum will not have the benefit of a review of the material by any securities regulatory authority in Canada.

Fidante and the Challenger entities are not authorised deposit-taking institutions (ADI) for the purpose of the Banking Act 1959 (Cth), and their obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante or the Challenger entities. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.

Fidante Partners Europe Limited

Authorised and regulated by the Financial Conduct Authority Fidante. Registered Office: Bridge House, Level 3, 181 Queen Victoria Street, London, EC4V 4EG. Registered in England and Wales No. 4040660.

Fidante Partners AB

An investment firm authorised by the Finansinspektionen. Kungsgatan 8, SE-111 43 Stockholm, Sweden. Registered in Sweden No 559327-5497

Challenger Management Services (UK) Limited Authorised and regulated by the Financial Conduct Authority Fidante Registered Office: Bridge House, Level 3, 181 Queen Victoria Street, London, EC4V 4EG. Registered in England and Wales No. 06393787.

The Fidante and Challenger entities are wholly owned subsidiaries of Challenger Limited, a company listed on the Australian Securities Exchange Limited.