UK Water Utilities: Why do we invest in one?

The environmental failures of water utilities across the UK and the financial failure of Thames Water, has rightly led to increased scrutiny of the entire water sector. The sector was initially privatised by the Thatcher government in the late 1980’s, and Thames Water, now on the brink of going under, is the poster child of rampant corporate greed and declining public services. Yet there’s a risk of throwing the baby out with the bath water, as some water utilities have performed much better than others.

The publicly listed water companies with shares traded on the London Stock Exchange have outperformed the privately held water utilities such as Thames Water, both operationally and financially. The three publicly listed water utilities, Severn Trent, United Utilities, and Pennon Group, have more robust operational performance, stronger balance sheets and a history of superior regulatory returns. And although still not great, they also have superior environmental performance, with fewer serious pollution violations.

From an investment perspective, of the three listed water utilities, two stand out; United Utilities and Severn Trent have stronger balance sheets, sustainable dividends (currently yielding 4.9% and 4.5% respectively), and demonstrated outperformance of operational and environmental commitments. We currently prefer United Utilities over Severn Trent based on valuation and higher growth trajectory. Despite trading at a discount, we don’t favour Pennon Group due to weaker environmental performance and higher leverage after the acquisition of SES Water in January 2024.

Superior Performance

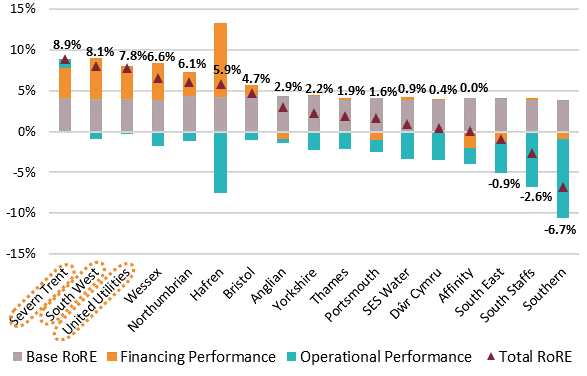

The listed water utilities have achieved superior return on equity so far in the current regulatory period of AMP7 (April 2020 to March 2025). From April 2020 to March 2023, Severn Trent (8.9%), South West Water owned by Pennon Group (8.1%) and United Utilities (7.8%) have significantly outperformed the unlisted water utilities on the achieved RoRE (return on regulatory equity).

In the unlisted space1, Wessex Water and Northumbrian Water Limited are the only ones to have outperformed Ofwat’s base regulatory return of 4.7% so far in AMP7. Returns for all other unlisted water companies are in the range of -6.7% to +2.9%.

Listed water utilities have achieved higher returns by outperforming on financial and operational objectives set by the regulator, Ofwat, and on cost allowances set for expenditure and cost of debt.

CHART 1: REGULATORY RETURNS ACHIEVED BY WATER UTILITIES (APR 2020 – MAR 2023)

Strong Financial Discipline

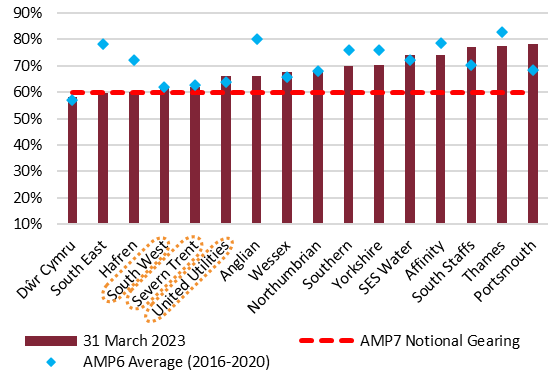

The gearing metric2 reported by Ofwat shows that listed water companies were among the safest in the sector with relatively lower levels of debt. As of 31 March 2023, the three listed companies had between 62% and 66% of their regulatory capital value financed with debt, which is very close to the notional regulatory gearing of 60% assumed by Ofwat for AMP7. Among the unlisted water utilities, only Dŵr Cymru Welsh Water and South East Water were less leveraged than the listed companies.

Thames Water, which is currently in severe financial distress, is the most leveraged company in the sector. In addition, Thames also has a much higher share of inflation linked debt. While in theory this is an efficient way of financing a water utility, as they have inflation-linked revenue growth, it can cause trouble in high inflationary periods where the debt levels are already too high (hello 2023). Thames’ poor operational and environmental performance then highlighted the problem of old, fragile infrastructure, with no room left in the balance sheet to fund improvements without more equity injected.

CHART 2: REGULATORY GEARING – UK WATER UTILITIES

Source: PATRIZIA, Ofwat

In comparison, listed water companies are in much better shape, with considerably lower levels of leverage, solid investment grade credit ratings, appropriate level of inflation linked debt and superior FFO/net debt and interest cover metrics.

Environmental Performance

UK water utilities face high scrutiny on the environmental issues including leakage, flooding and sewer overflows leading raw sewage discharge into waterways. Addressing these issues will require large investment by water companies to upgrade their facilities and replace ageing infrastructure.

Severn Trent and United Utilities have been the best performers in the sector on environmental issues. In its 2023 Environmental Performance Assessment (EPA), the UK Government’s Environment Agency has rated only three companies United Utilities (listed), Severn Trent (listed) and Wessex Water (unlisted) at the best possible four-star rating. United Utilities has achieved the industry leading four-star rating three times in the last four years, while Severn Trent has been consistently rated four-star in the past five years. The worst environmental performance was found in four unlisted companies; Thames Water, Southern Water, Yorkshire Water and Anglian Water, with 90% of 47 severe pollution incidents in 2023 caused by these four.

Increased Investment and Funding Needs

Recognising the sector wide challenges, for the 2025-30 regulatory period (AMP8), Ofwat has in principle approved £88 billion of total spending, which is £29 billion more than the current period. The increase in total expenditure will be driven by higher investments in sewer overflow, pollution reduction, improving river and bathing water quality and tackling the impacts of climate change.

This step up in allowed expenditure will be beneficial to the water companies, as they will grow their RCVs over the next five years at a faster rate. However, the companies with already exhausted balance sheets will need to bring in larger equity injections to fund their capital programs, as they will still need to comply with Ofwat’s updated license requirements for a minimum credit rating of BBB and potentially lower notional regulatory gearing of 55%.

Listed water companies will receive £28 billion of the total £88 billion expenditure allowed. United Utilities has been provided a total expenditure allowance of £12 billion over the 2025-30 period, which is £4.5 billion or 60% more than the company will have spent in the current period of 2020-25. Severn Trent’s allowance has been approved at £15.6 billion, which is £4.3 billion more than the current period. In our view, both companies are better placed than most unlisted water companies.

Valuation

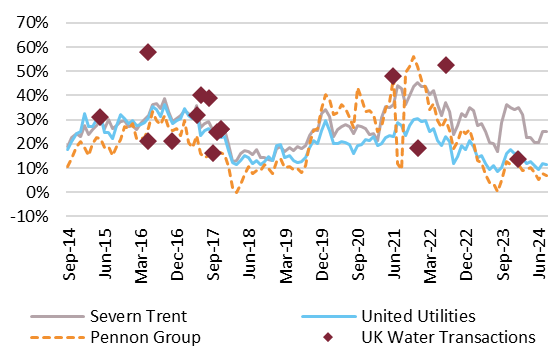

With increased regulatory visibility for the sector until 2030 and both inflation and interest rates falling, we think that listed water companies are currently trading at attractive valuations. The fundamentals remain strong for these companies with considerably lower risk compared to some of the companies in the sector which have loaded up on debt.

As of 30 August 2024, United Utilities was trading at 11.3% premium to its regulated capital value (RCV) and Severn Trent was trading at 25.2% premium to its RCV. There have been four private market transactions in the sector since 2021, with investors demanding premiums of 48% and 53% for higher quality companies with superior regulatory performance and healthier debt levels.

In contrast, target companies with lower returns and high debt levels were transacted at EV/RCV premiums of 14% and 18%.

In our view, United Utilities remains the most attractive listed water company based on current valuation. Pennon Group is currently trading at a discount to the other two, however, it needs to address its poorer environmental performance and has assumed additional debt by acquiring SES Water in January 2024.

CHART 3: EV TO RCV PREMIUM (DISCOUNT) - %

Source: PATRIZIA, S&P Capital IQ, Ofwat

1 Pennon Group PLC acquired Bristol Water in June 2021, and the Welsh water utility Hafren Dyfrdwy Cyfyngedig was purchased by Severn Trent PLC in 2017.

2 Regulatory measuring measures each company’s reported net debt as a proportion of its Regulatory Capital Value (RCV). RCV is total value of the regulated asset base held by water utilities which is adjusted annually for the inflationary element, and includes all new investment allowed by Ofwat less depreciation of the existing assets.

Important Information: PATRIZIA Pty Ltd (ACN 008 636 717), Australian Financial Services Licence 244434 is authorised and regulated by the Australian Securities and Investments Commission (ASIC); (“PATRIZIA”).

This document has been prepared by PATRIZIA and any information contained herein is directed at wholesale clients only. It is not directed at, or intended for retail clients as defined by the Corporations Act 2001.

The information contained in the document is our professional assessment based on the available data but, by its nature, cannot be guaranteed and should not be relied on as an indication of future performance.

Opinions expressed in this document may be based on assumptions and contingencies. To the extent permitted by law, PATRIZIA and its officers, employees, agents, associates, and advisers make no representations or warranties in relation to the accuracy, reliability, currency, completeness or relevance of the information contained in, and accept no liability whatsoever to any third party in relation to any matter arising from this document or for any reliance that any recipient may seek to place upon such information.

This document contains commercial-in-confidence information and should not be disclosed to any party. This information may not be excerpted from, summarised, distributed, reproduced or used without the prior written consent of PATRIZIA.