03 Feb 25

Insight

Global Equities

2025 EM Outlook: Reading the tea leaves

Emerging markets are poised for a resurgence in 2025, driven by robust fundamentals, attractive valuations, and opportunities in key regions like China, Indonesia, and Vietnam, making this an opportune time for investors.

04 Apr 24

Insight

Global Equities

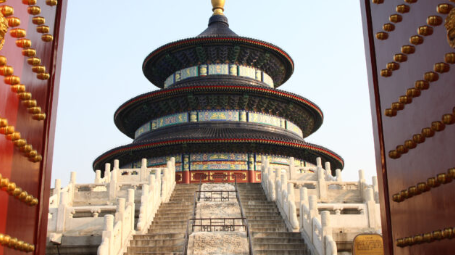

China Equities: The Time is Nigh

Chinese equities are trading at extremely attractive levels, and in our view, the outlook is highly prospective for long term investors.

26 Feb 24

Insight

Global Equities

Revisiting the GFC playbook

Chinese equities are trading at mouth-watering attractive levels. In our view, the outlook is highly prospective for long term investors. As highlighted in our early January 2024 insights, we believe the issues facing the Chinese economy are well known and manageable! Many new policies and initiatives are being introduced to support and stimulate the economy. The economy will find its footing in 2024. Contrary to numerous pessimistic headlines, the Chinese economy is set to expand between 4.5% to low 5% range in 2024.

07 Feb 24

Insight

Global Equities

2024 Outlook: An inflection point for Emerging Markets

Welcome to 2024, the Year of the Dragon in the Chinese Zodiac. We believe the fundamentals are in place for emerging markets (EM) to outperform developed economies (DM) in the coming year. Many EM central banks, with a few exceptions, were first to react to combat inflation by shifting monetary policy and tighten financial conditions. As a result, many EMs were the first economies to loosen monetary policies in 2023 which will support growth in 2024.

15 Jan 24

Insight

Global Equities

Why Bother Investing in China?

The investment philosophy of Ox Capital is to buy champion businesses of the future when valuations are depressed. Typically, reason for the negativity is obvious. Our job, as long-term investors, is to look past short-term disruptions, and determine if the businesses possess strong economic moat which enable them to become champion companies in the future.