04 Apr 24

Insight

Global Equities

China Equities: The Time is Nigh

Chinese equities are trading at extremely attractive levels, and in our view, the outlook is highly prospective for long term investors.

15 Mar 24

Insight

Fixed Income

Troubled Times Ahead?

The saying that all good things must come to an end is a bittersweet reflection of reality. Sadly, too many of us fail to appreciate those good times, often focusing on what could or might go wrong. Perhaps this is understandable given the potential for higher interest rates to stifle economic growth and an increasingly complex geopolitical environment.

07 Mar 24

Insight

Australian Equities

Global Equities

ESG in 10 -Episode 15: The disproportionate impact of modern slavery on women and girls

In this episode we explore the disproportionate impact of modern slavery on women and girls and what investors can do about the issue.

28 Feb 24

Insight

Alternatives

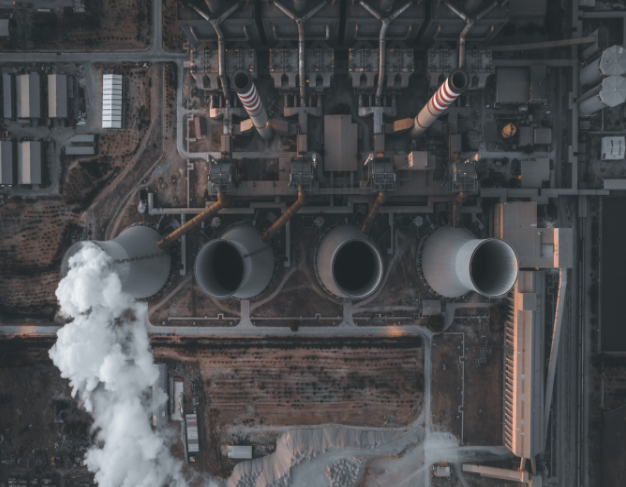

Heat Management: Industrial Cooling Solutions

Demand for data storage and processing, accelerated by online meetings and AI advancements, is driving the growth of the data centre industry which requires significant cooling.

Industrial cooling consumes large quantities of water and energy, releasing carbon emissions and waste heat. Efficient cooling solutions are essential for achieving carbon reduction targets and complying with tightening reporting requirements.

26 Feb 24

Insight

Global Equities

Revisiting the GFC playbook

Chinese equities are trading at mouth-watering attractive levels. In our view, the outlook is highly prospective for long term investors. As highlighted in our early January 2024 insights, we believe the issues facing the Chinese economy are well known and manageable! Many new policies and initiatives are being introduced to support and stimulate the economy. The economy will find its footing in 2024. Contrary to numerous pessimistic headlines, the Chinese economy is set to expand between 4.5% to low 5% range in 2024.

07 Feb 24

Insight

Alternatives

Sustainable Solutions for Industrial Heat Management

Three-quarters of energy used in industry is converted into heat and over half of total energy used is lost as waste heat.

Industrial heating is largely powered by non-renewable resources; producers attempting to achieve carbon reduction targets are looking for alternative, sustainable solutions for generating process heat and recovering energy wasted as heat.

07 Feb 24

Insight

Global Equities

2024 Outlook: An inflection point for Emerging Markets

Welcome to 2024, the Year of the Dragon in the Chinese Zodiac. We believe the fundamentals are in place for emerging markets (EM) to outperform developed economies (DM) in the coming year. Many EM central banks, with a few exceptions, were first to react to combat inflation by shifting monetary policy and tighten financial conditions. As a result, many EMs were the first economies to loosen monetary policies in 2023 which will support growth in 2024.

30 Jan 24

Insight

Fixed Income

Key Themes for 2024: Fixed Income

Ardea Investment Management is a specialist relative value investor, focusing on non-directional opportunities within the global fixed income market. Unlike more traditional fixed income mangers, our investment process seeks to identify and exploit mispricing between assets with similar risk characteristics and does not rely on forecasts for the direction of interest rates or other macroeconomic variables to generate performance.

24 Jan 24

Insight

Fixed Income

Pure Relative Value: The Third Lever of Fixed Income

“In a world that is constantly changing, there is no one subject or set of subjects that will serve you for the foreseeable future, let alone for the rest of your life.” So said the American author, John Naisbitt, whose analysis of social trends led to predictions regarding automation in the workplace, globalisation and even the rise of artificial intelligence.